Overview

The Advance Payment functionality gives users the ability to record an advance payment (deposit) against a specific vendor subcontract and track the recovery/amortization of the advance payment through the RFP progress payments.

Accounting Transactions

Advanced Payment creates two separate transactions that are posted to accounts at separate stages. It is different than the current way CMiC handles deposits. The Advanced Payment is an invoice that does not impact job costing.

When Advanced Payment is posted

DR

|

Advance Payment Control account

|

CR

|

AP Subcontractor Liability account (Accounts Payable)

|

When Advanced Payment check is posted

DR

|

AP Subcontractor Liability account (Accounts Payable) |

CR

|

Bank Cash account

|

When Amortization of Advanced Payment is posted

DR

|

Job Cost Expenses

|

CR

|

AP Subcontractor Liability account (Accounts Payable)

|

CR

|

Advance Payment Control account |

CR

|

Retainage Payable |

When Amortization of Advanced Payment check is posted

DR

|

AP Subcontractor Liability account (Accounts Payable) |

CR

|

Bank Cash account |

Setup

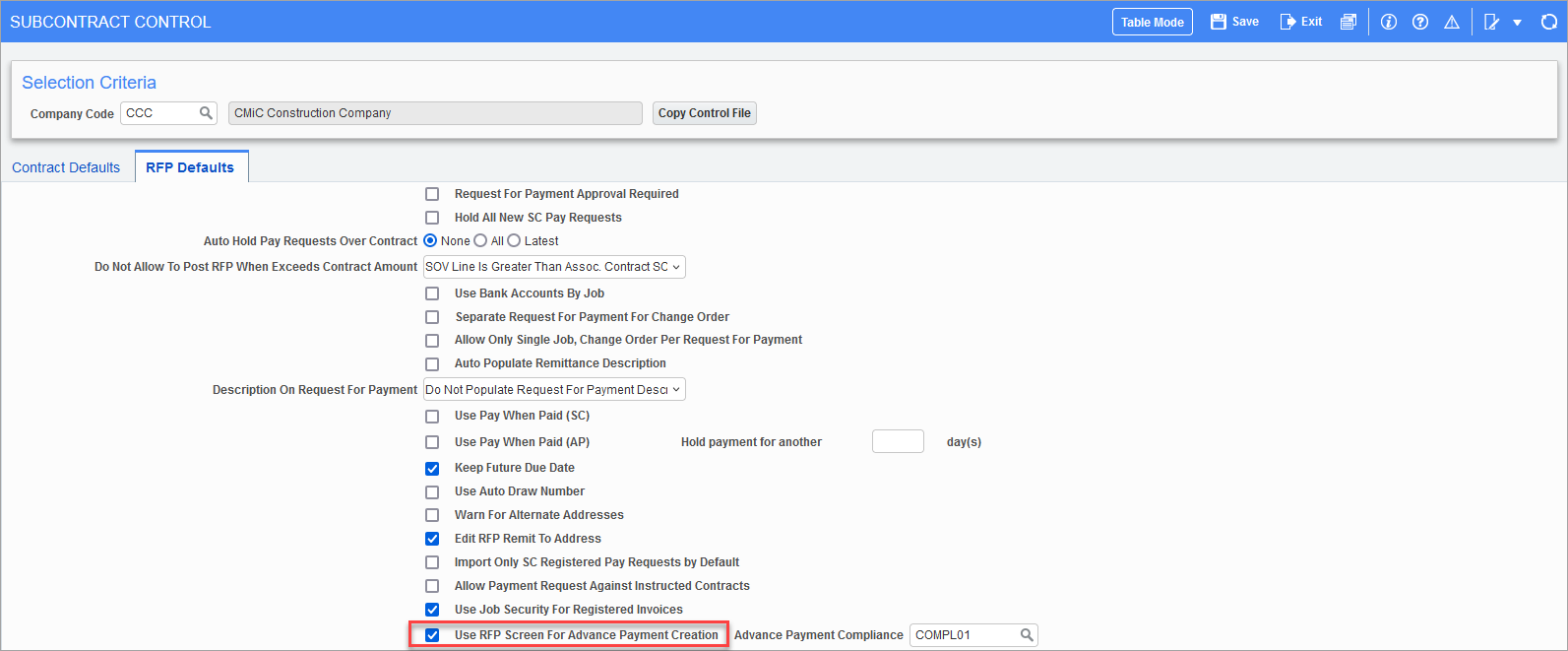

-

In the Subcontract Management Control File, check the 'Use RFP Screen for Advance Payment Creation' box on the RFP Defaults tab.

-

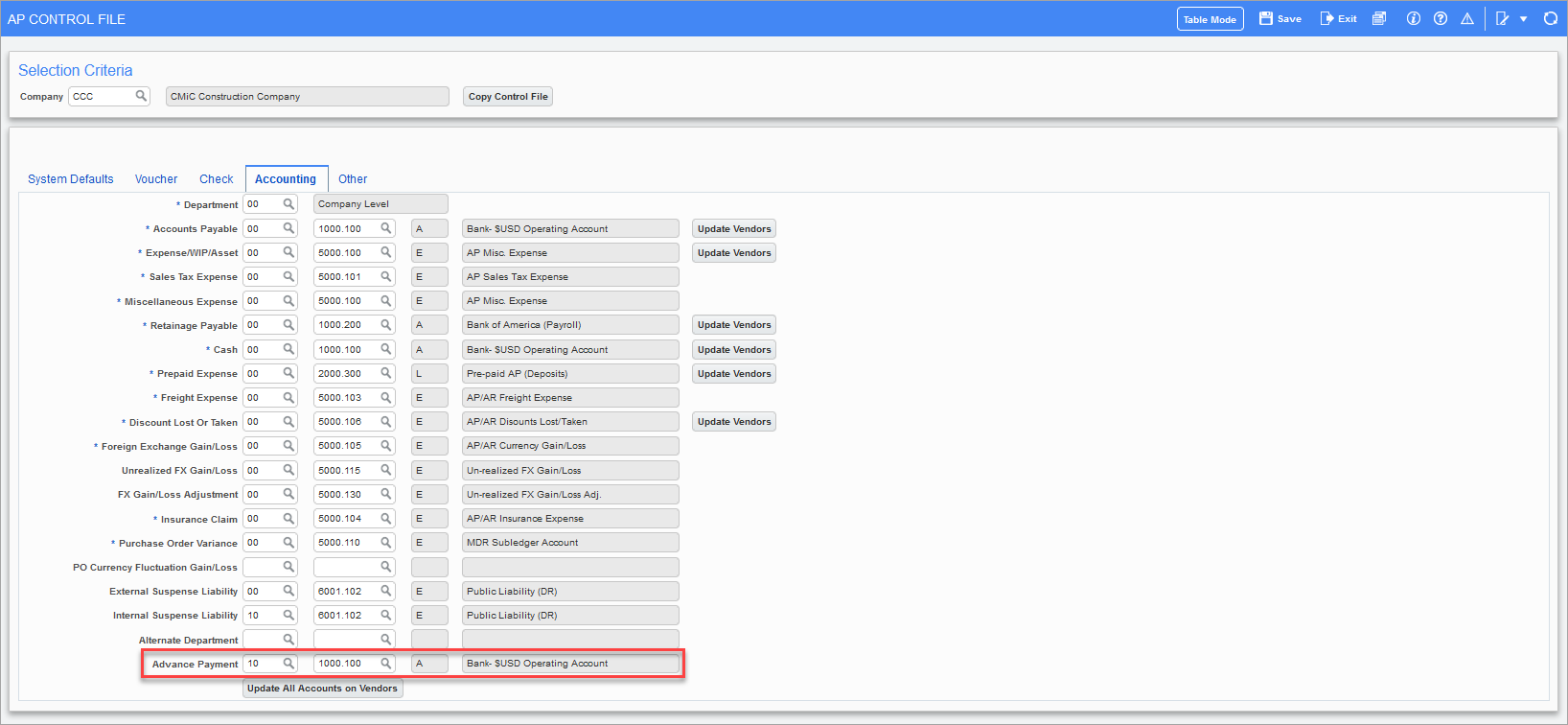

In the Accounts Payable Control File, setup the department and account for Advance Payment on the Accounting tab.

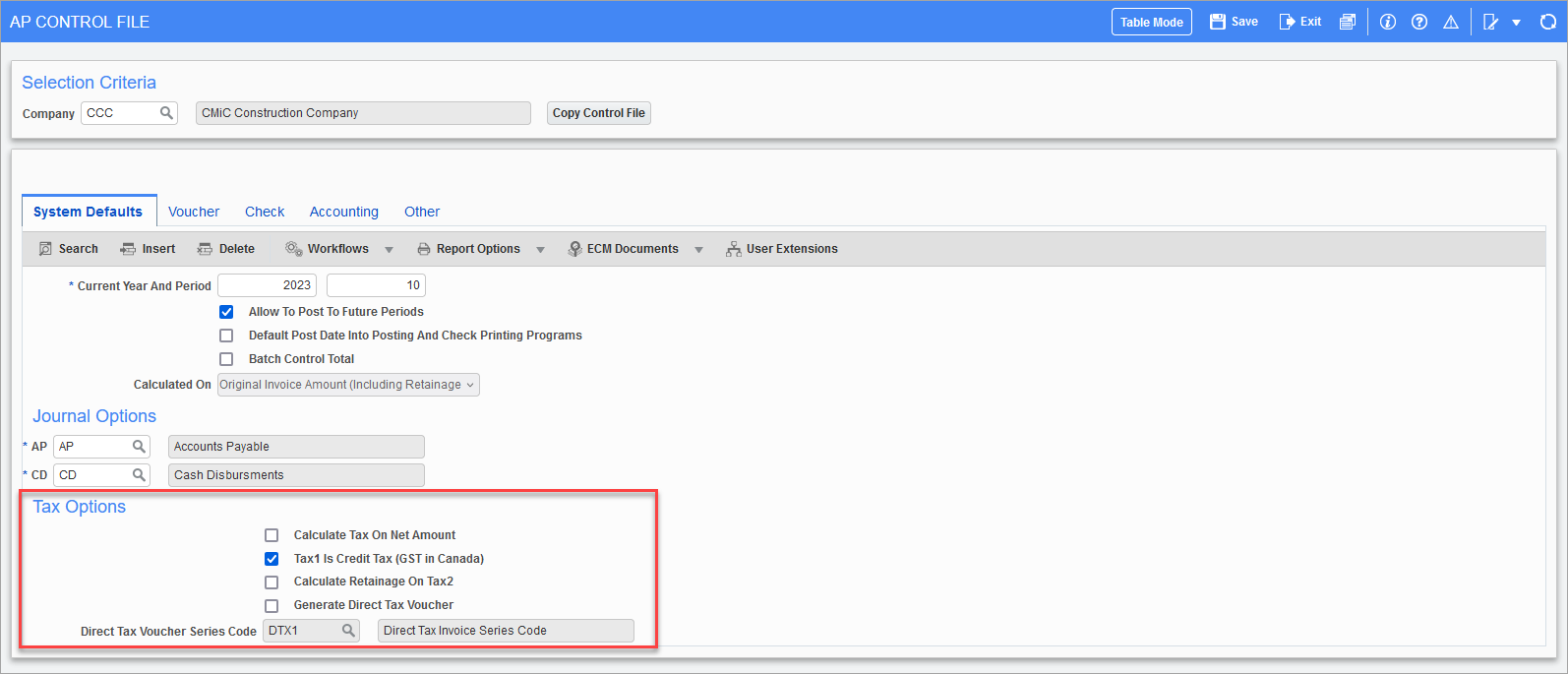

Under the System Defaults tab, set up the tax under the Tax Options section. For example, enable credit taxes.

-

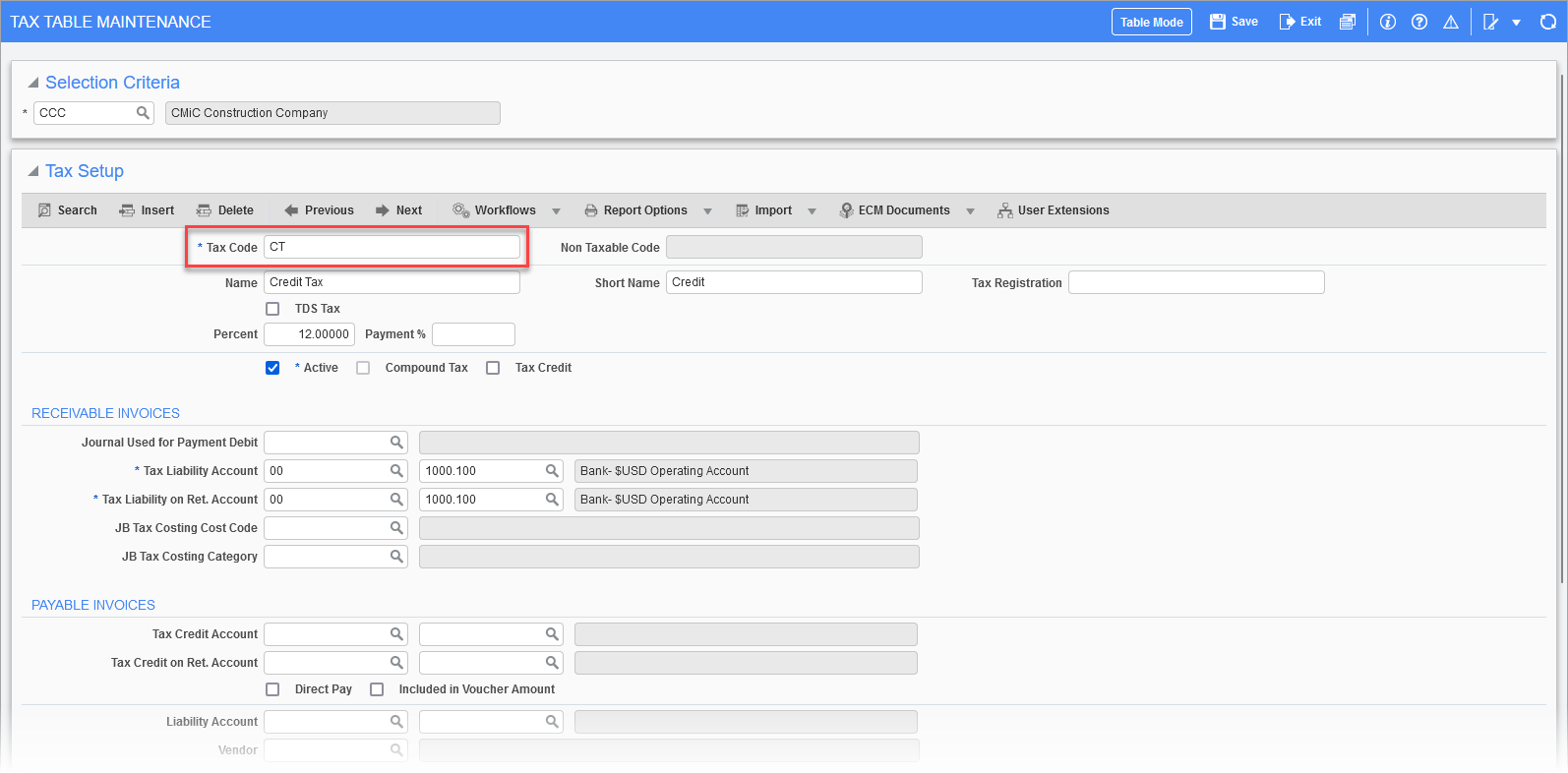

On the Tax Table Maintenance screen in the Accounts Payable module, set up the appropriate tax codes.

Advance Payment Creation

-

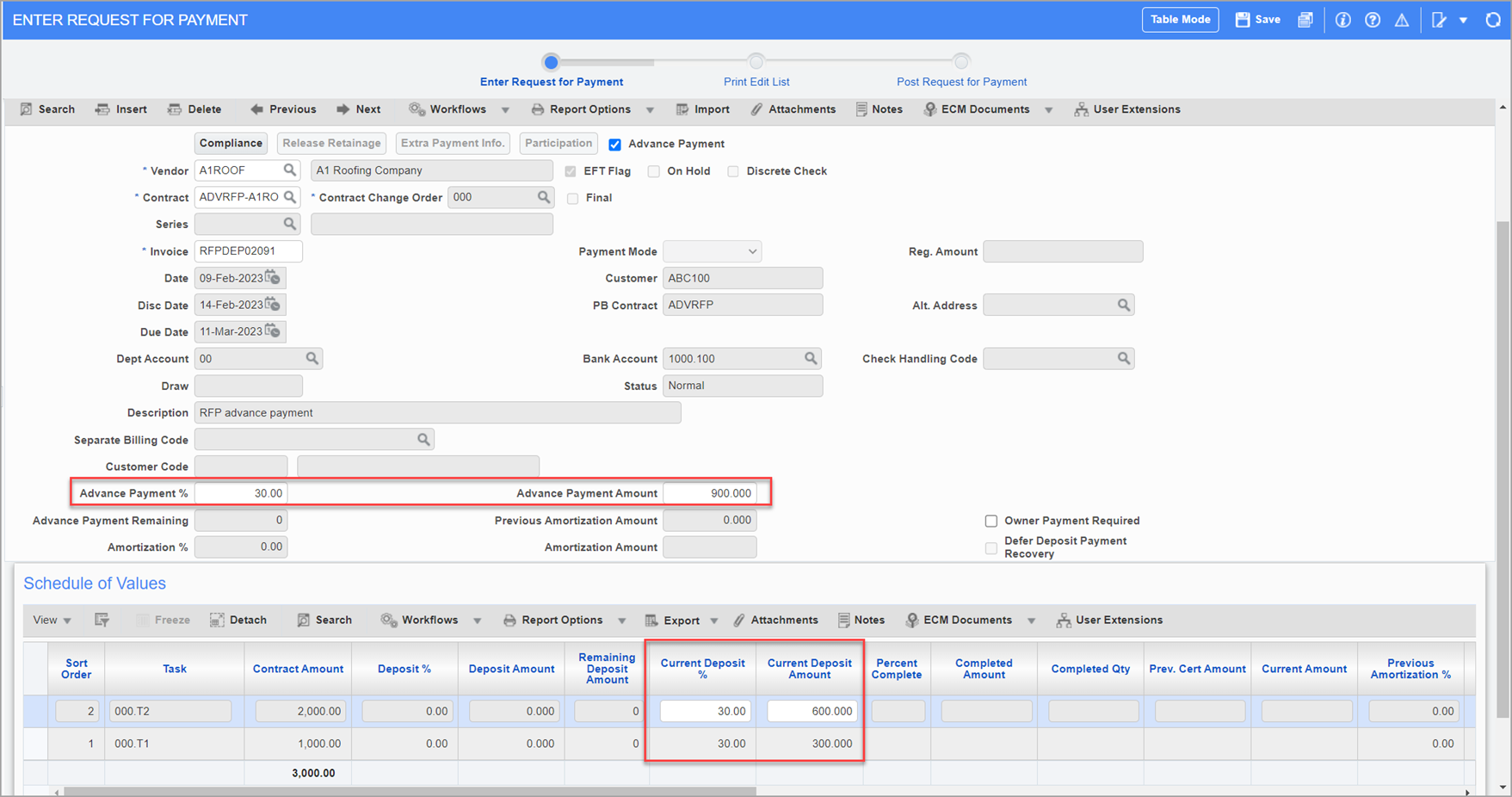

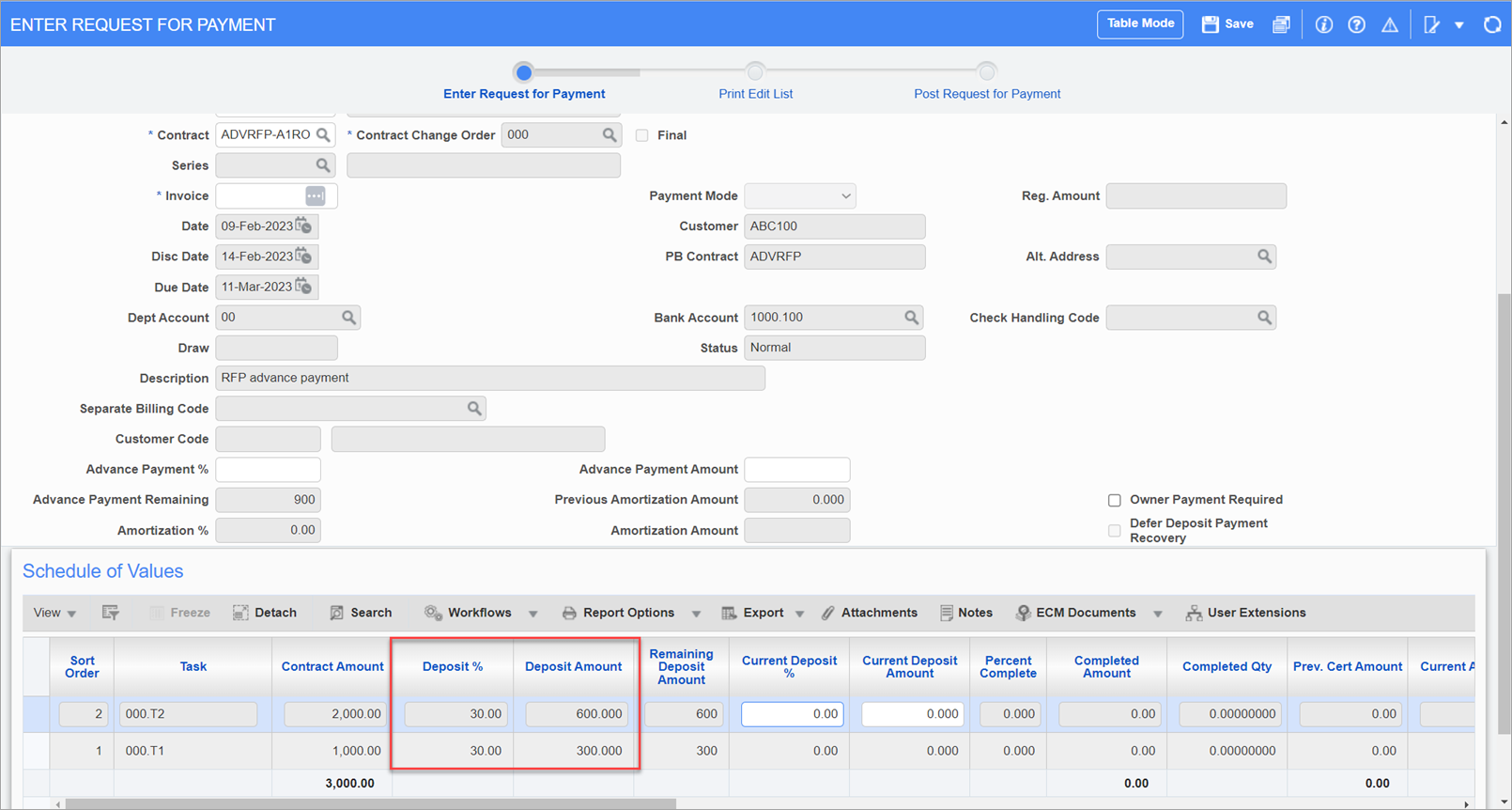

Select the desired subcontract and check the 'Advance Payment' box in the Enter Request For Payment screen. The Advance Payment % and Advance Payment Amount on the Details tab and SOV lines on the Schedule of Values section becomes available.

-

The RFP cannot contain any other amounts except deposit related amounts on it, e.g. Current Amount, Current Quantity, Current Release Amount, and Current Material Stored Amount. Those fields and Amortization related fields are disabled.

-

Enter a value for the Advance Payment % field in the Details tab. The system automatically populates the Current Deposit % field from the Detail tab to the SOV lines and auto-calculates the Advance Payment Amount and Current Deposit Amount fields in the Detail tab and SOV lines. The Advance Payment % column can be overridden in the SOV lines.

-

Enter a value for the Advance Payment Amount field in the Details tab. The system automatically calculates the Advance Payment % field and then populates the Current Deposit % field from the Details tab to the SOV lines and auto-calculates the Current Deposit Amount column in the SOV lines. The Advance Payment Amount column can be overridden in the SOV lines.

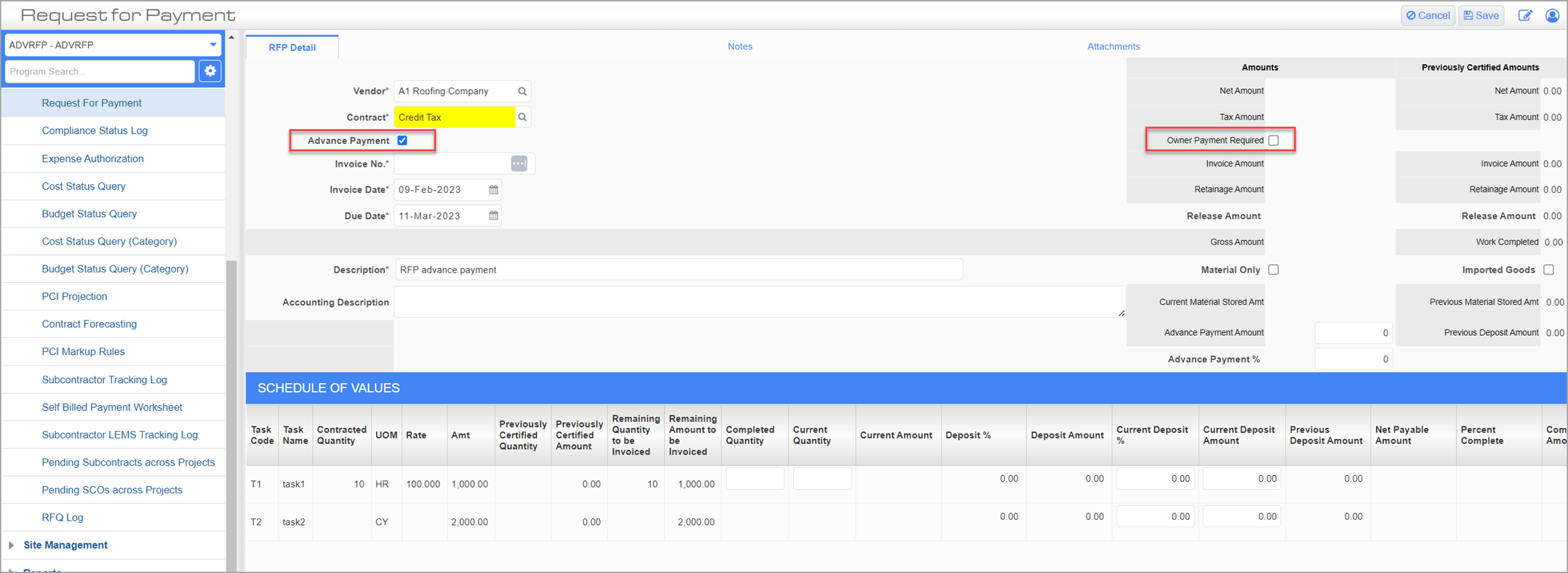

Users can also create an Advance Payment RFP in the Request For Payment screen on CMiC Field.

-

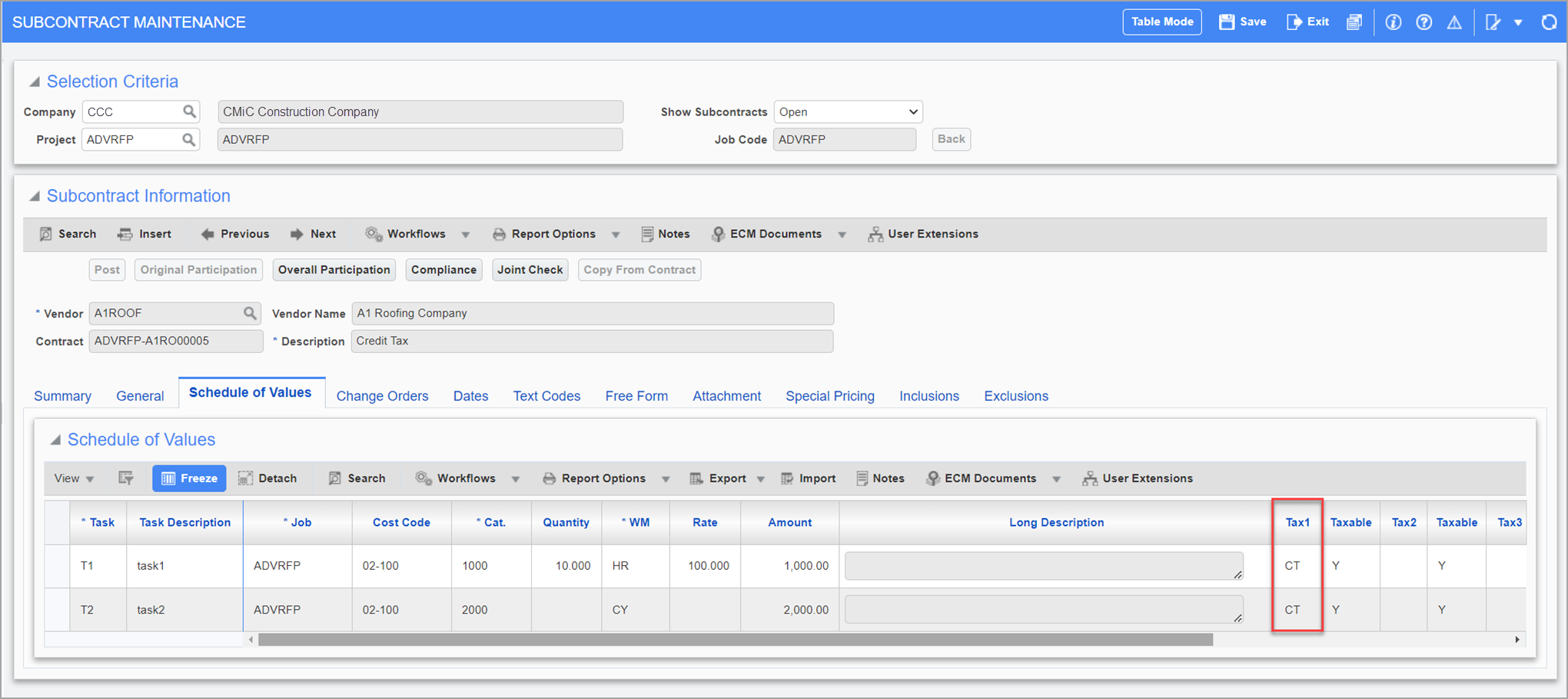

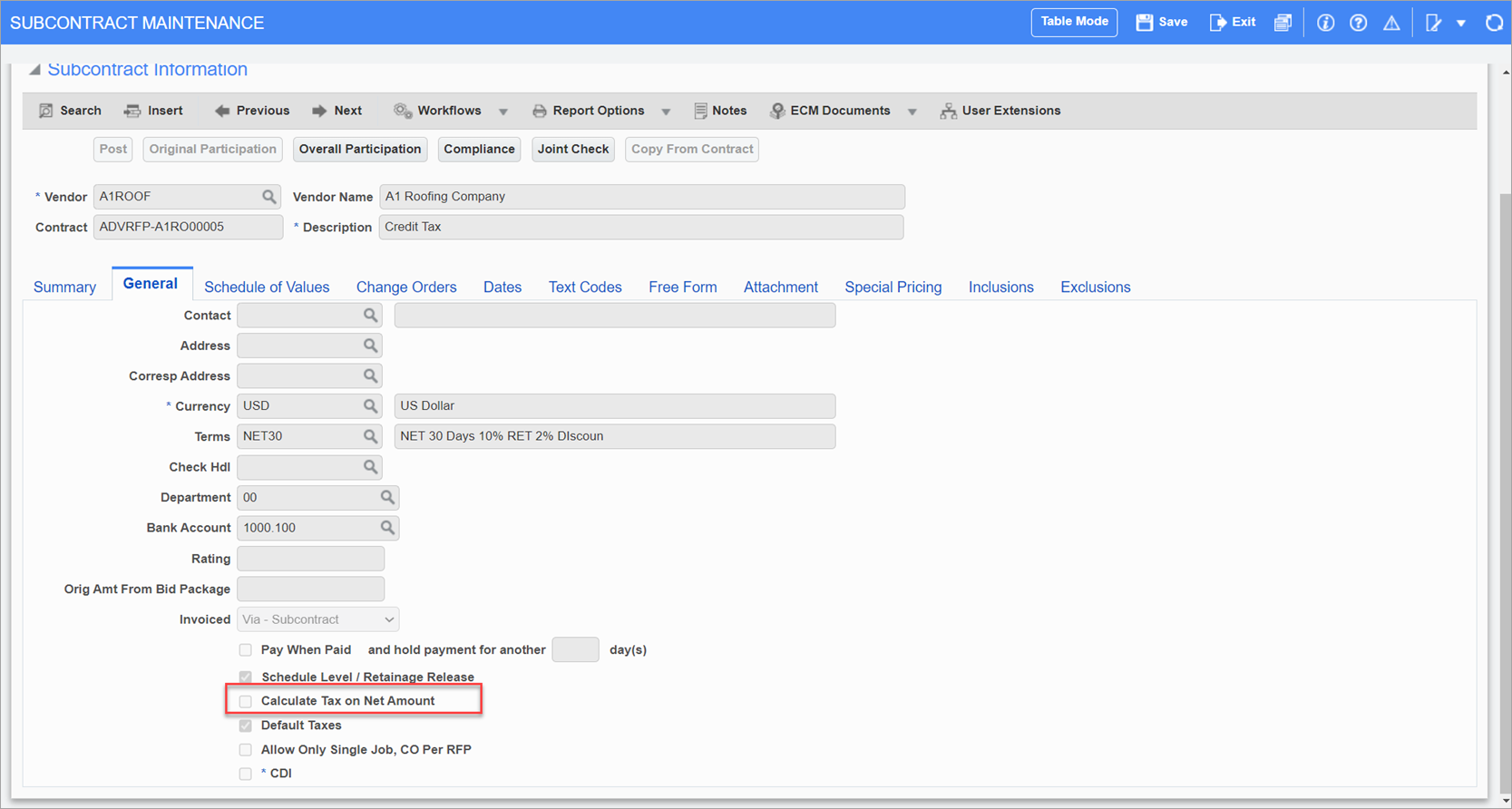

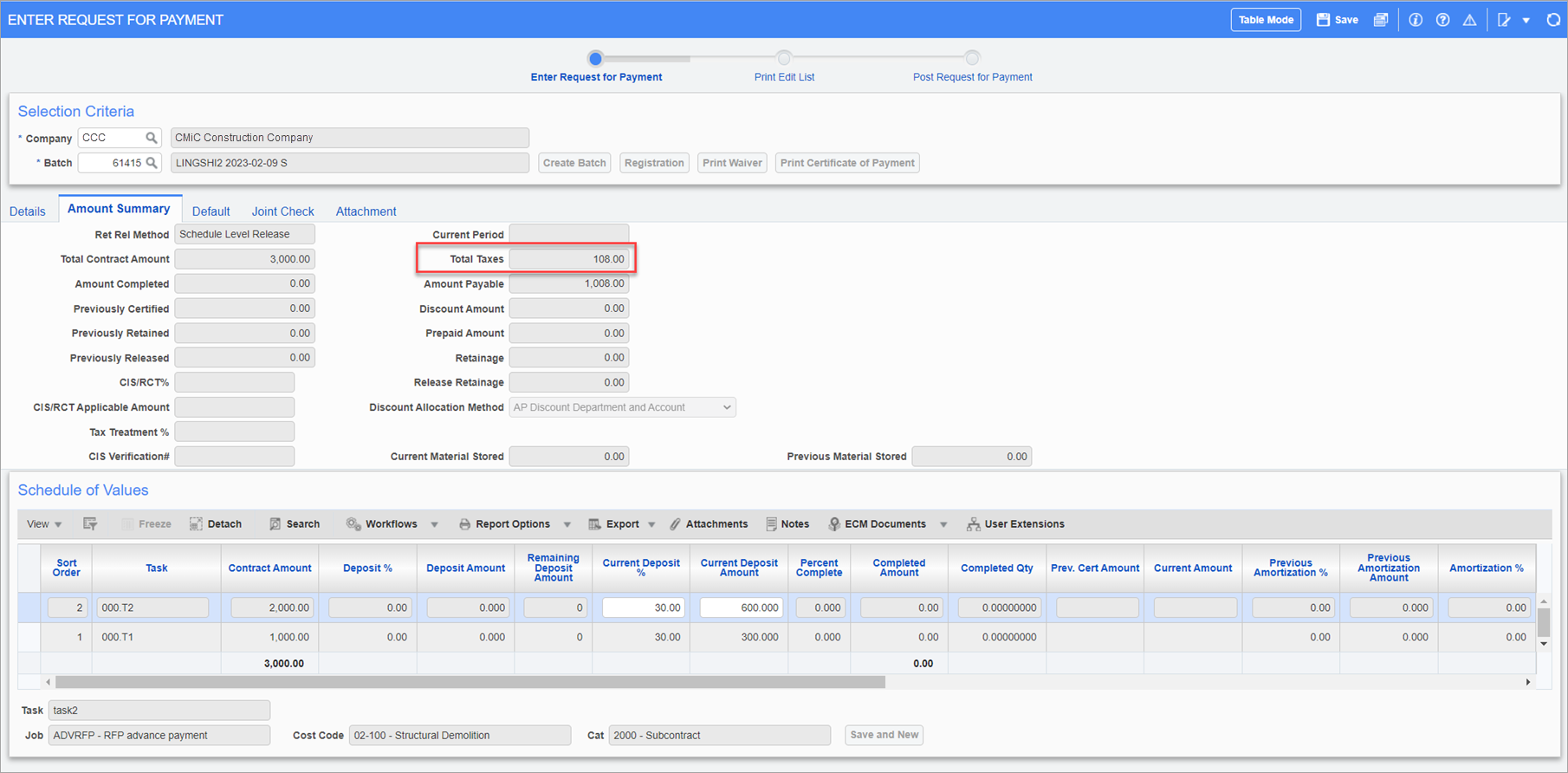

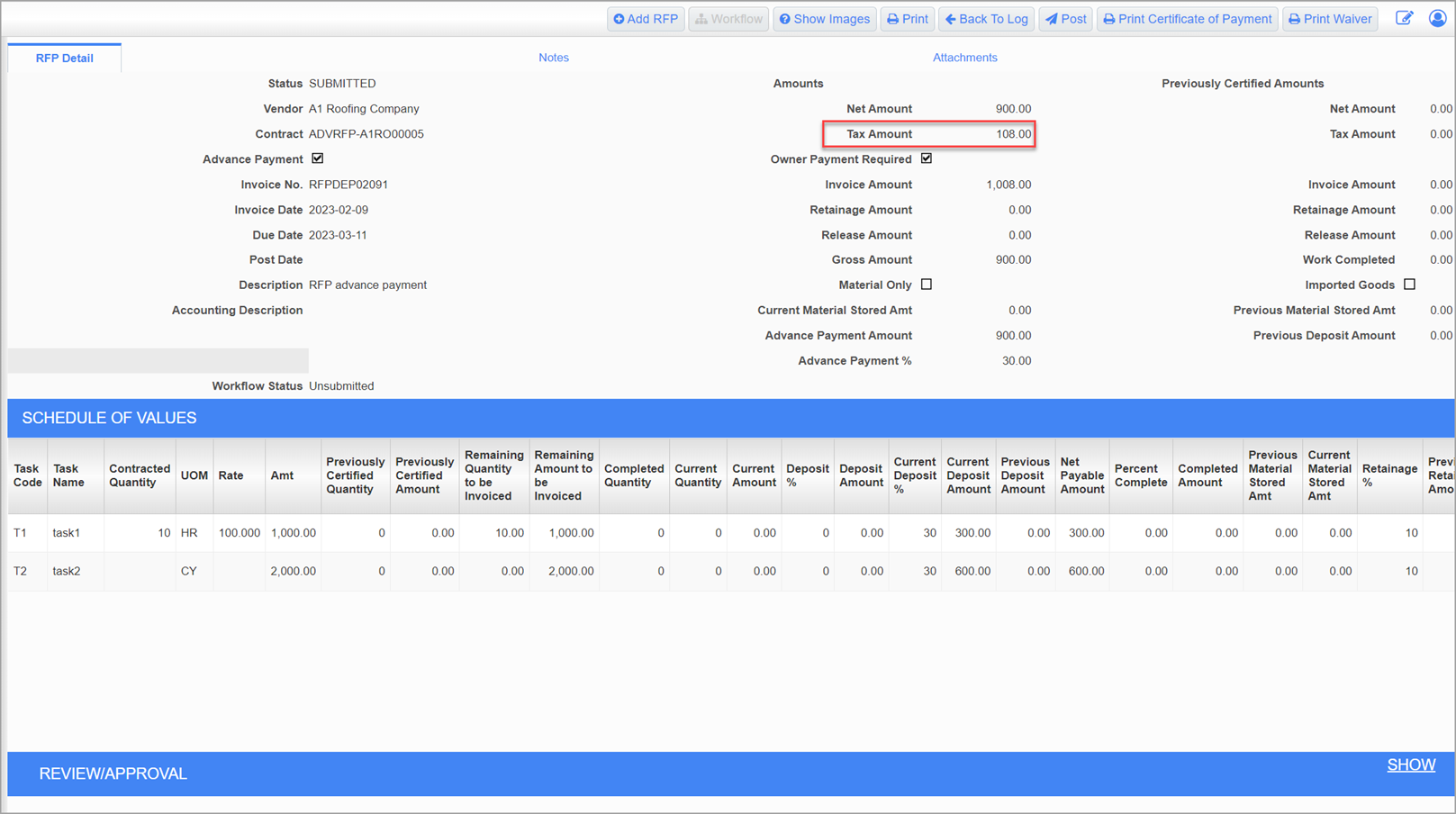

The tax amount is calculated on the advance payment fields according to the tax setup on the General tab and Schedule of Values tab of the Subcontract Maintenance screen.

-

Post an Advance Payment RFP.

When an Advance Payment RFP is posted, while creating the distribution for the voucher, a new G type line is created for the Advance Payment Amount of 900.00, linked to the Advance Payment Control Account, which is added on the Accounting tab of the AP Control File.

The amount on regular J type lines is 0.

The following illustrates how Advance Payment RFP transactions are applied:

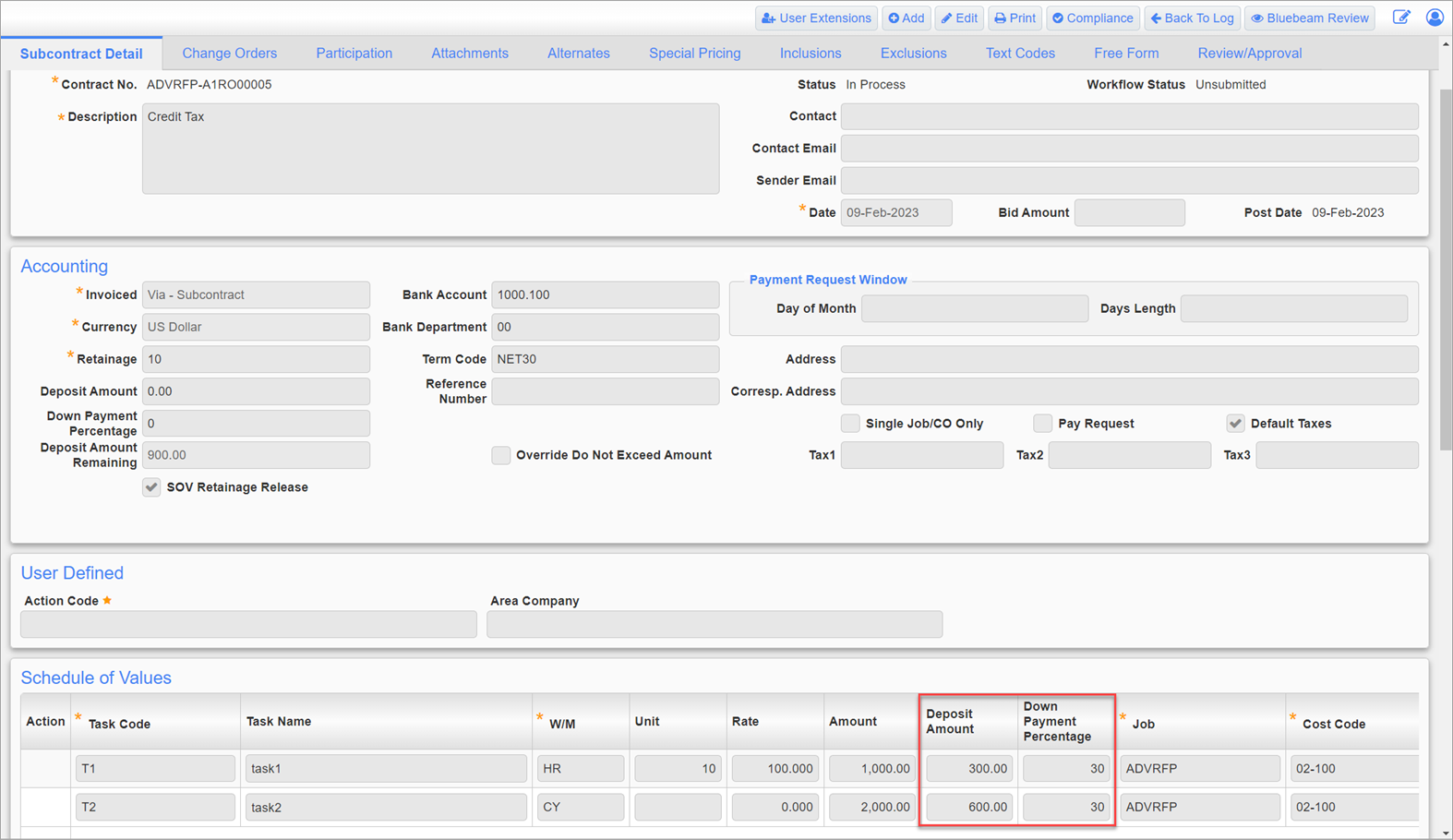

DR Advance Payment Control Account$900.00DR Job Cost Expenses$0.00DR Tax Credit Account$108.00CR AP Subcontractor Liability Account$1008.00After an Advance Payment RFP is posted, the subcontract's Deposit Amount field is updated. The Deposit % and Deposit Amount columns in the RFP SOV lines are also updated.

The deposit amount and percentage are also visible on the Subcontract Detail tab of the Subcontract Entry screen in CMiC Field after the Advance Payment RFP is posted.

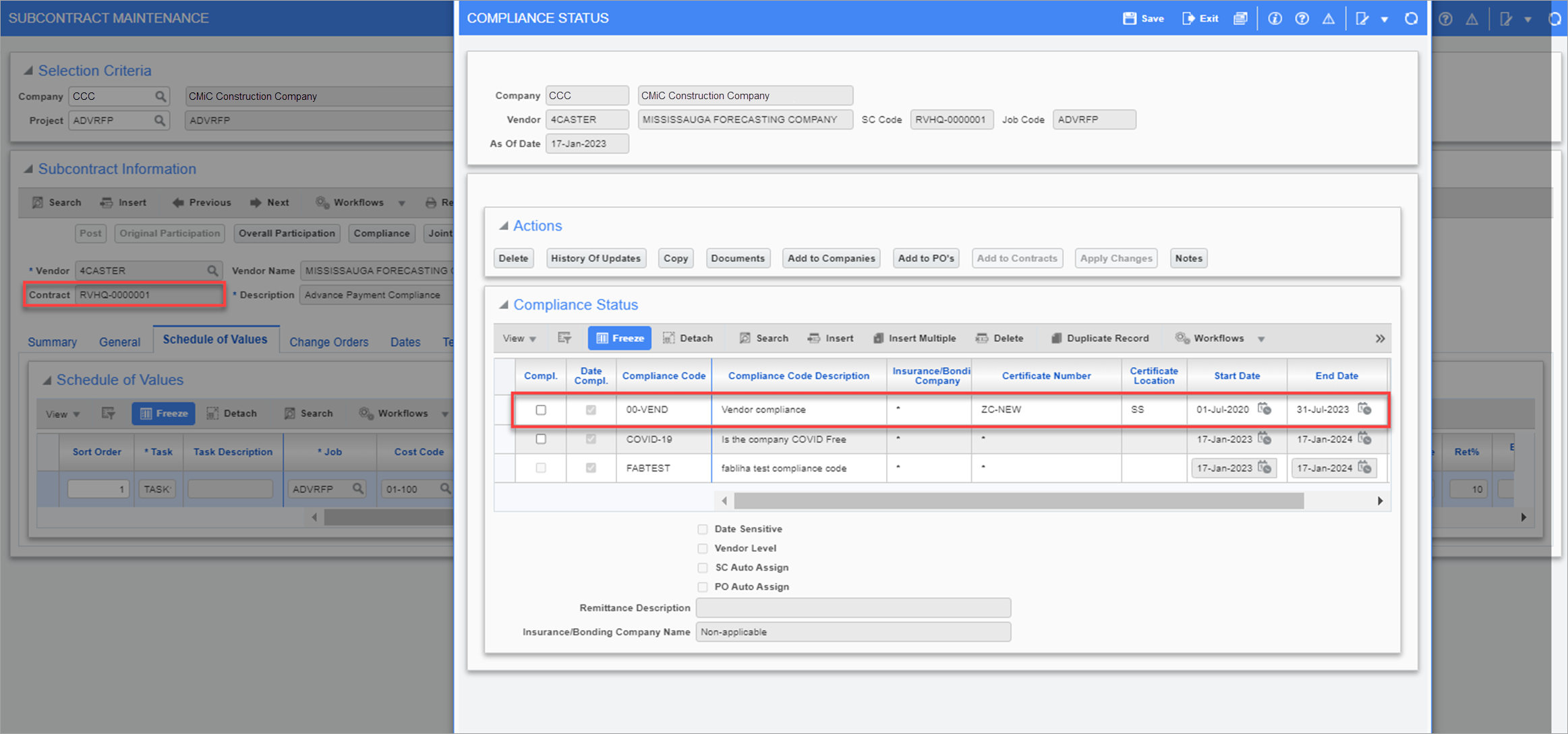

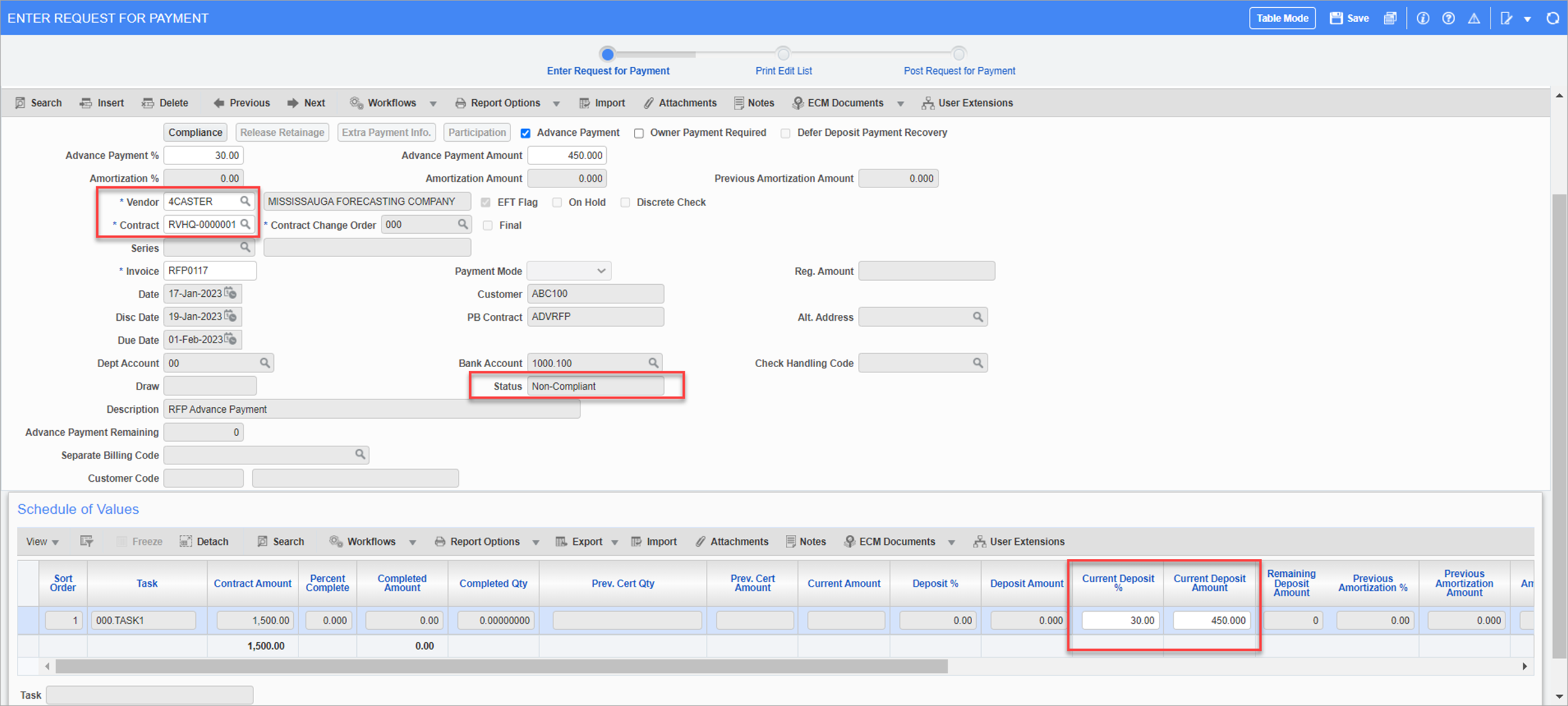

Advance Payment Creation with Compliance Validation

If the Advance Payment Compliance is assigned to the subcontract or the RFP while posting the RFP, then it must be compliant. If it is not compliant, the posting will stop with an error.

-

Create an Advance Payment RFP for a deposit amount of $450:

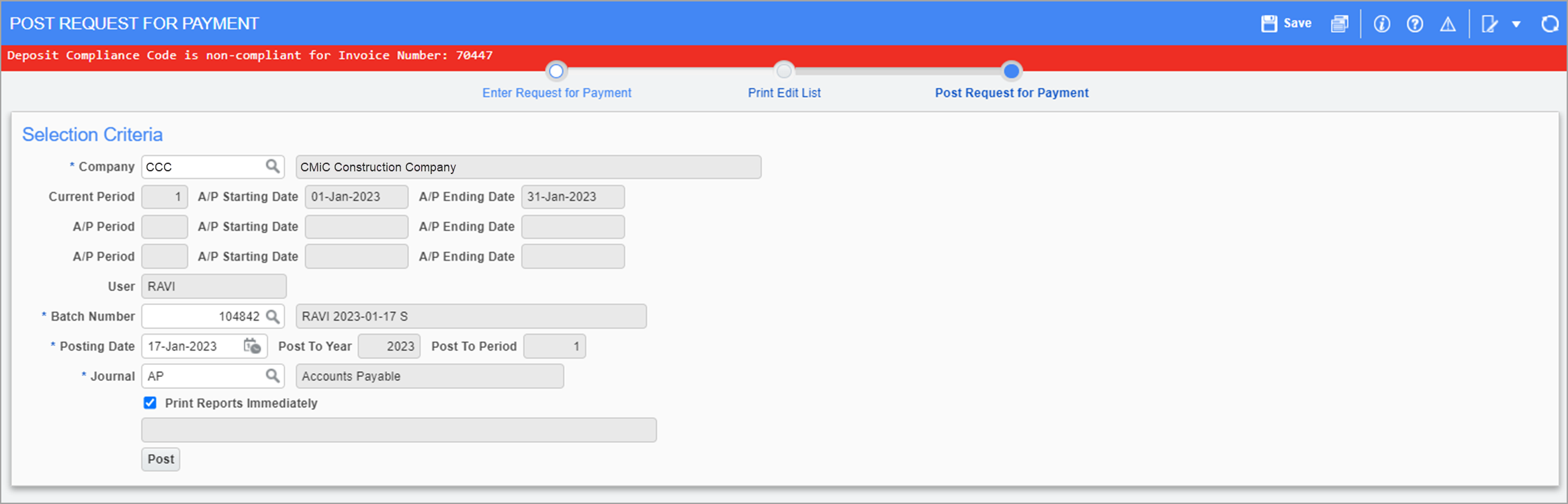

-

After trying to post the RFP, the posting stops with the error message, "Deposit Compliance Code is non-compliant for Invoice Number: XXXXX".

NOTE: Creating an Advance Payment RFP with compliance validation is currently in development for CMiC Field.

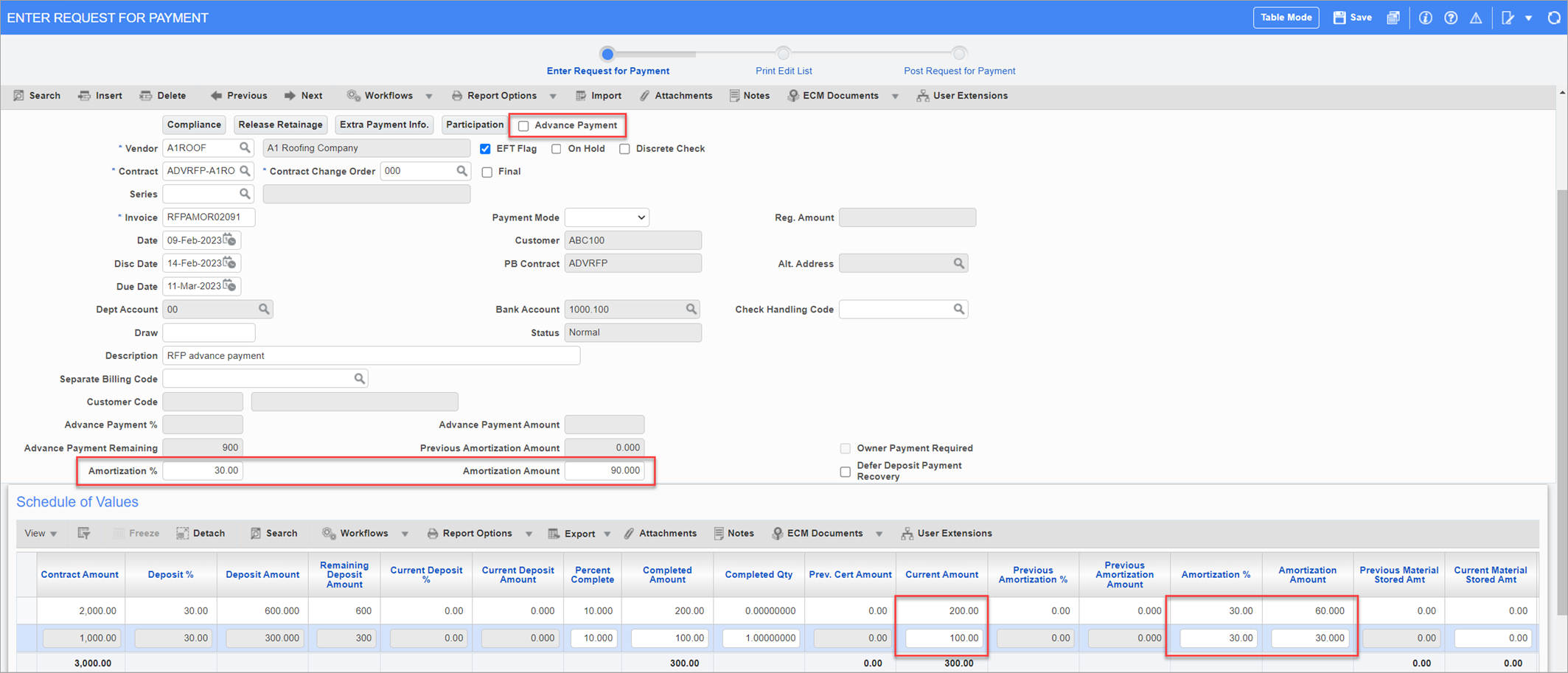

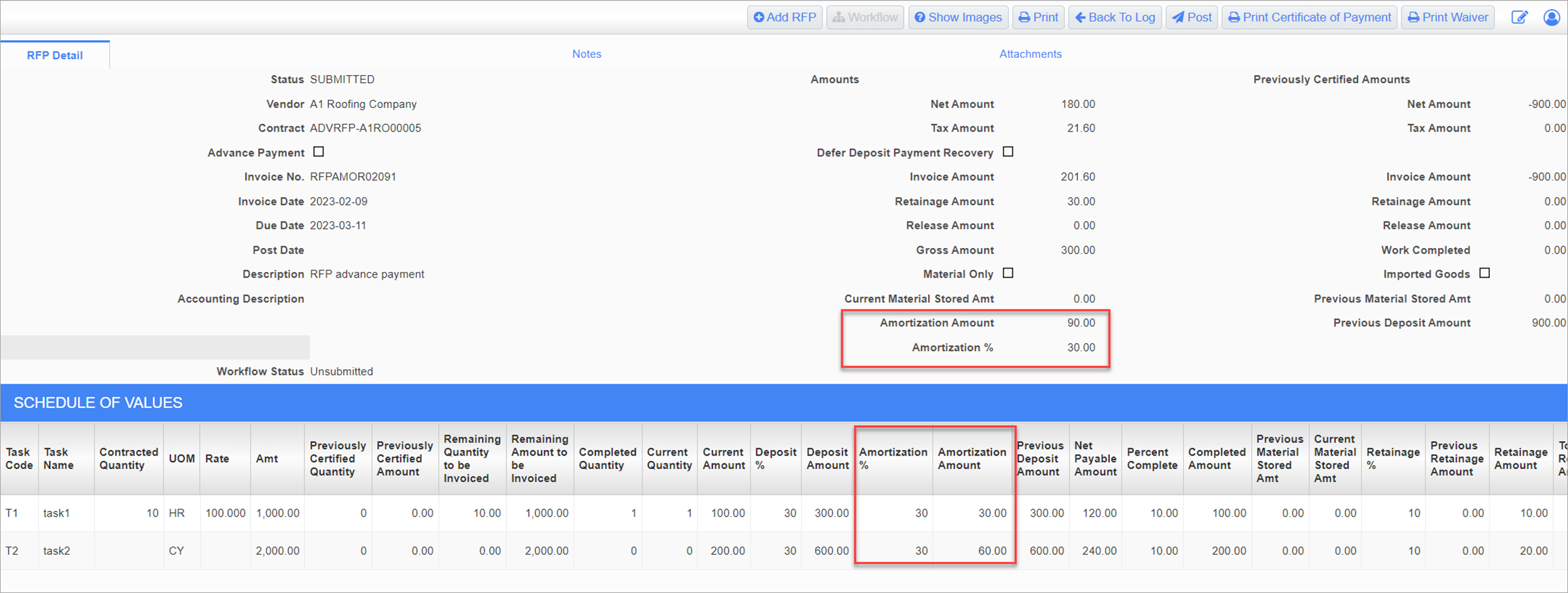

Amortization of the Advance Payment Amount

-

The subcontract deposit amount can be amortized on the regular RFP. The 'Advance Payment' checkbox on the Enter Request for Payment screen in Subcontract Management must be unchecked during entry.

-

On the new RFP with amortization, the Amortization % column on the SOV defaults with the value from the Deposit % column on the SOV. The Amortization Amount is calculated as

Amortization Amount = Amortization Percent × Current Amount.

The Amortization % and Amortization Amount columns can be overridden on the SOV lines or on the Details tab of the Enter Request for Payment screen.

-

Post the amortization of the advance payment on the regular RFP.

When the RFP with an amortization amount is posted, the accounting transaction credits the Advance Payment Control account 75.00 as the total amortization amount, and it debits 100.00 for the SOV on a regular J type lines.

If a tax credit applies, the Tax Credit is calculated as:

Tax Credit = (Current Amount - Amortization Amount - Retainage) × 12%

In this example, the tax credit does not apply so,

Tax Amount = 0.00.

If retainage exists, the Tax Credit on Retainage is calculated as:

Tax Credit on Retainage = Retainage × 12%

The Net Amount is calculated as,

Net Amount = Current Amount - Amortization Amount

In this example,

Net Amount = 100 – 75 = 25

Advanced Payment Remaining is calculated as,

Advanced Payment Remaining = Previous Advanced Payment Remaining - Amortization Amount

In this example,

Advanced Payment Remaining = 200 – 75 = 125

The following illustrates how the transactions in the RFP with amortization are applied.

DRTax Credit Account$0.00DRTax Credit on Ret. Account$0.00DRJob Cost Expenses$100.00CRAP Subcontractor Liability Account$25.00CRRetainage Payable$0.00CRAdvance Payment Control Account$75.00 -

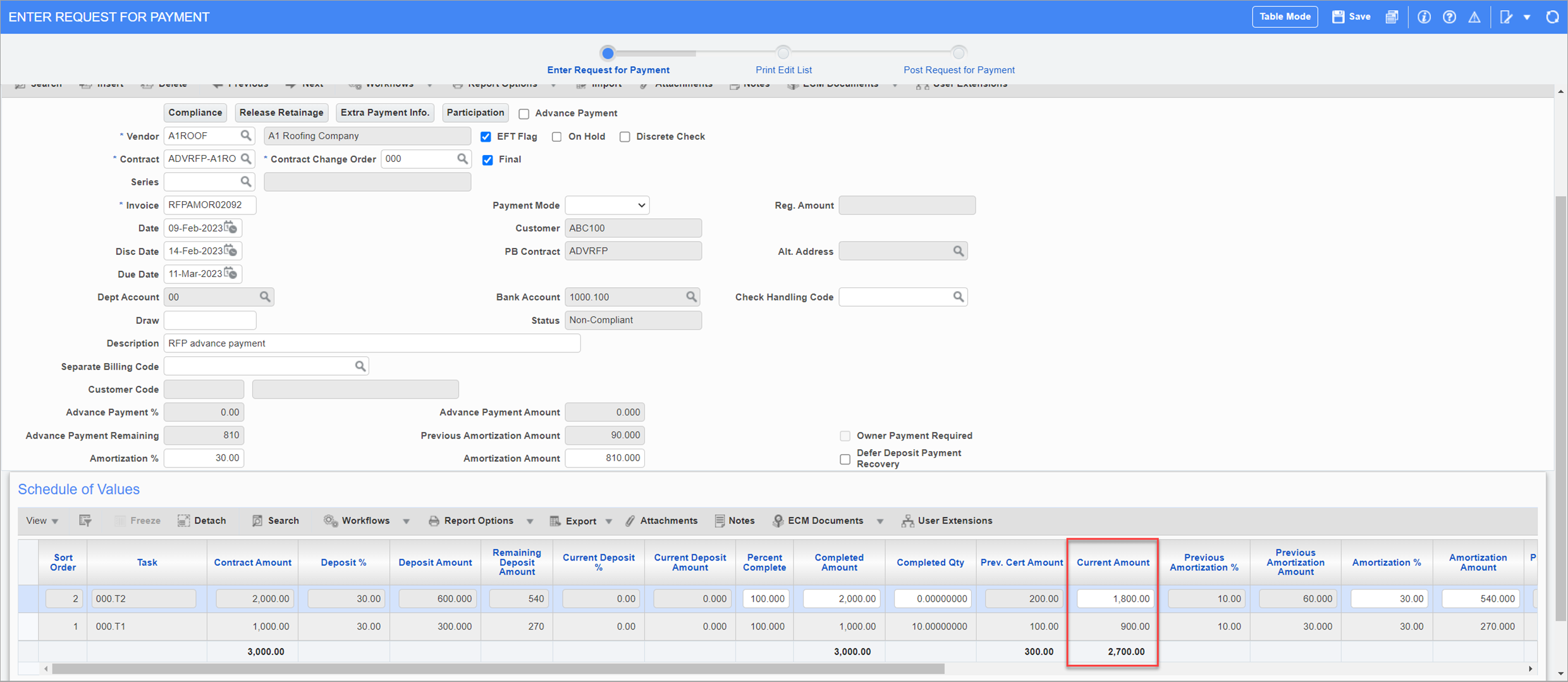

Post the second RFP of 200.00 with amortization.

We see the Net Amount makes the next payable within the amortization. Meaning the vendor is only paid the difference plus the new payable. The Net Amount in the Previously Certified Amounts will continue to grow with the new net amounts on each RFP. In this example, Net Amount = 200 (Current Amount) + 25 (Previous Amount) = 225.

The following illustrates how transactions in the RFP with Amortization are applied.

DRTax Credit Account$0.00DRTax Credit on Ret. Account$0.00DRJob Cost Expenses$200.00CRAP Subcontractor Liability Account$108.00CRRetainage Payable$0.00CRAdvance Payment Control Account$92.00

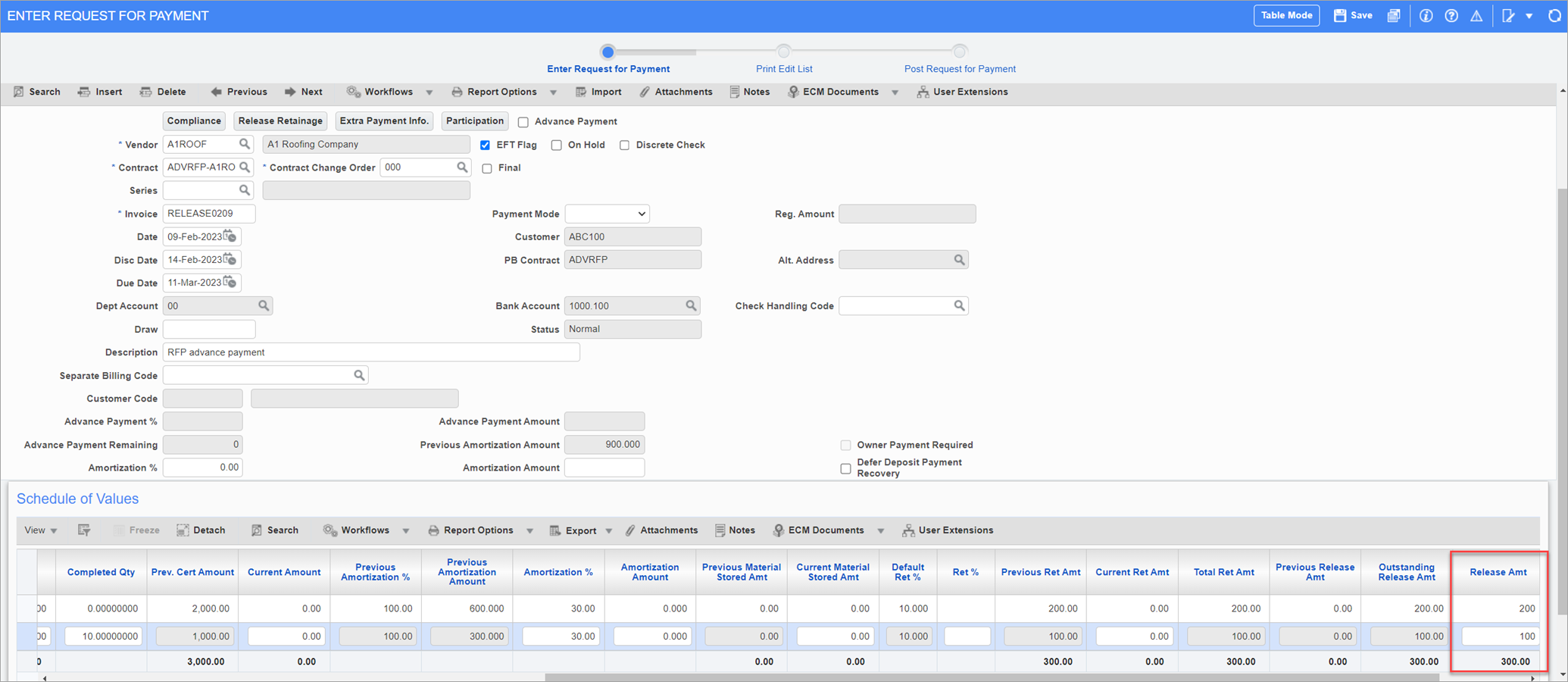

Release Retainage for Advance Payment

Users can release retainage at SOV level for advance payment RFPs as normal. For more details, see Retainage & Retainage Release.

The following illustrates how Retainage Release transactions are applied in the above example.

CR |

AP Subcontractor Liability Account

|

$336.00

|

DR |

Retainage Payable

|

$336.00 |

DR |

Job Cost Expenses

|

$0.00

|

DR |

Tax Credit Account

|

$36.00

|

CR |

Tax Credit on Ret. Account

|

$36.00 |

Void Advance Payment RFPs

Users can void advance payment RFPs as normal. For more details, see Void Request for Payment.

-

Void the retainage release.

CRTax Credit Account$36.00DRTax Credit on Ret. Account$36.00DRAP Subcontractor Liability Account$336.00CRRetainage Payable$336.00 -

Void the second RFP with amortization.

RFPs with amortization of advance payment can be voided via the Void Request for Payment screen.

If a check has been issued against the pay request, users must void the check before voiding the RFP.

CRTax Credit Account$194.4CRTax Credit on Ret. Account$32.4DRAdvance Payment Control Account$810.00DRAP Subcontractor Liability Account$1814.4DRRetainage Payable$302.4CRJob Cost Expenses$2700.00 -

Void the first RFP with amortization.

CRTax Credit Account$21.60CRTax Credit on Ret. Account$3.60DRAdvance Payment Control Account$90.00DRAP Subcontractor Liability Account$201.60DRRetainage Payable$33.60CRJob Cost Expenses$300.00 -

Void the advance payment RFP.

Advance Payment can be voided via the Void Request for Payment screen.

If a check has been issued against the advance payment, users must void the check before voiding the advance payment. Likewise, if amortization has been created against the advance payment, users must void the amortization of the advance payment before voiding the advance payment.

CRTax Credit Account$108.00CRAdvance Payment Control Account$900.00DRAP Subcontractor Liability Account$1008.00

Void Subcontract for Advance Payment

The advance payment subcontract can be voided via the Void Contract screen. For more details, see Void Contract.