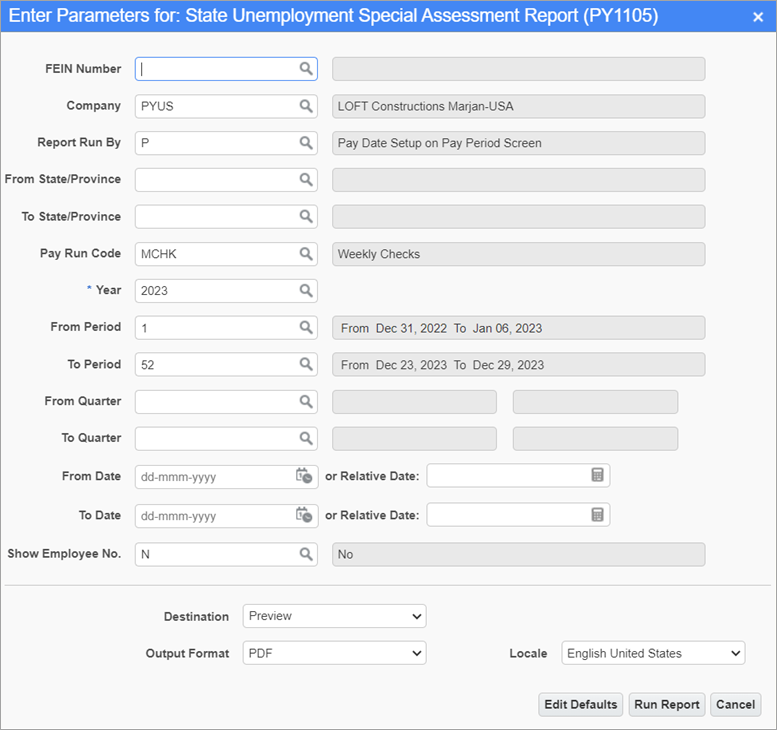

Pgm: PY1105 – State Unemployment Special Assessment Report; standard Treeview path: US Payroll > Reports > Tax Reports > State Unemployment Special Assessment Report

This screen is used to generate the State Unemployment Special Assessment Report for a specific year and specific pay periods in companies. The report includes employee personally identifiable information (PII), taxable wages, and periods paid.

NOTE: Federal, state, and local taxes must first be set up in order to use this screen. For more information, refer to US Payroll - Payroll Taxes - Overview.

Users can print the report for a specific company code or FEIN (Federal Employer Identification Number). FEINS are maintained in the FEIN Maintenance screen.

Report Run By

Enter/select one of the following codes from the Report Run By LOV to customize the report:

-

O: Actual Posting Dates to GL/JC

-

P: Pay Date Setup on Pay Period Screen

-

Q: Quarterly – Defined by Month on Pay Period Screen

-

R: Pay Period

-

C:Check Date

From/To State/Province

Enter/select a starting and ending state/province code to include the selected range of states/provinces on the report. Leave these fields blank to include all state/province codes on the report.

Relative Date

Select a substitution value expression for a relative date, such as the start of the week or the end of the quarter.

Show Employee No.

Enter/select "Y" for yes or "N" for no to include employee numbers on the report.

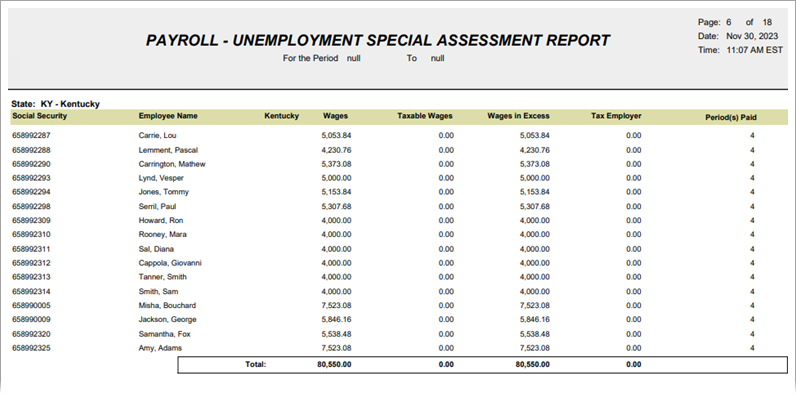

Sample State Unemployment Special Assessment Report (PY1105)