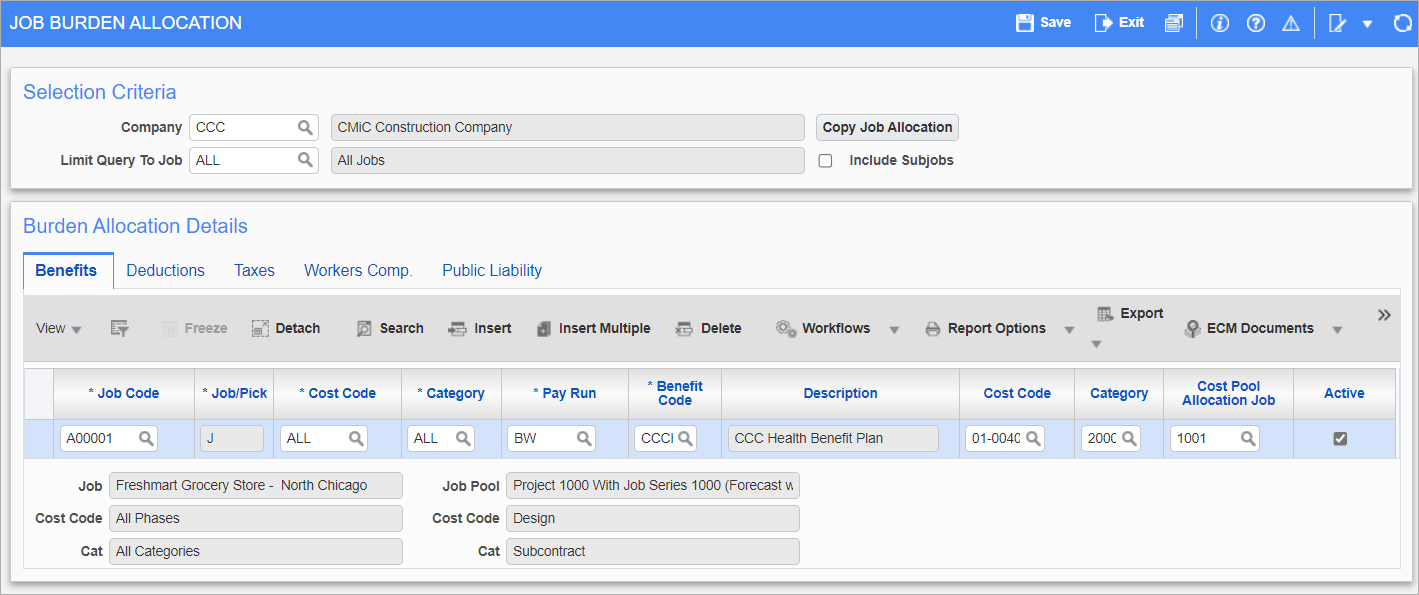

Pgm: PYJOBAL – Job Burden Allocation; standard Treeview path: US Payroll > Setup > Jobs > Job Burden Allocation

The Job Burden Allocation screen is used to define specific category elements to which benefits, deduction, or taxes can be allocated during the distribution of costs from timesheet entry to Job Costing. Benefits, deductions, and taxes are typically allocated to Job Costing in a proportional manner based on the allocation of timesheet labor costs to the selected jobs.

This screen also allows for the redirection of labor burdens where the allocation of benefits, deductions, and taxes requires a different code than the one specified by the timesheet wages.

Selection Criteria

Company

Enter/select the company code

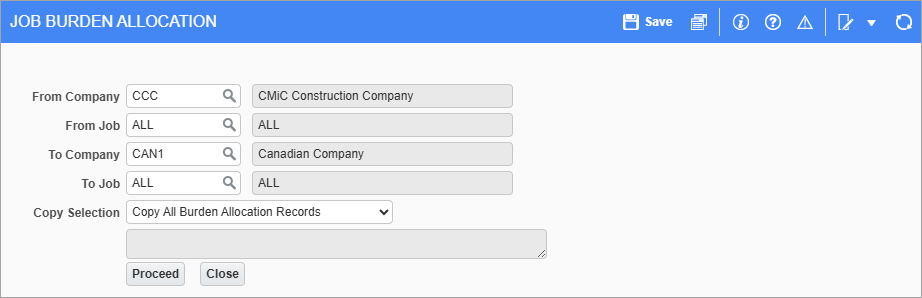

[Copy Job Allocation] – Button

Pop-up launched from [Copy Job Allocation] button

Press this button to copy job burden allocations between specific companies and jobs. Only records with a valid source job/phase/category will be copied to a valid destination job/phase/category.

Copy Selection

Select one of the following options:

-

Copy All Burden Allocation Records: The copy process will add new records and replace existing records if the source phase/category combination already exists for benefits, deductions, taxes, worker's compensation, and public liability burdens.

-

Copy New Burden Allocation Records: The copy process will create a copy of the allocation if the source phase/category combination does not already exist for benefits, deductions, taxes, worker's compensation, and public liability burdens and the destination job/phase/category is valid.

[Proceed] – Button

Press this button to copy the job burden allocations between the selected companies and jobs.

Limit Query To Job

Enter/select a job to limit the query by.

Include Subjobs – Checkbox

Check this box to include sub-jobs based on the selected job. If no job is selected, sub-jobs are listed whether or not this box is checked.

Benefit, Deduction, Taxes, Worker’s Comp, Public Liability – Tabs

The Job Burden Allocation screen is divided into five tabs: Benefits, Deductions, Taxes, Workers’ Compensation, and Public Liability. These screens are identical save for the category specific code field in each one.

Job Code

Enter/select the code for the job to which the burden should be allocated. If the same burden is being applied to all jobs, enter “ALL”. If the same burden is being applied to all bid jobs, enter “ALLBID”.

Cost Code, Category

Enter/select the cost code and category to which the burden is allocated.

Pay Run

Enter/select the pay run for the job to which the burden is allocated.

Benefit, Deduction, Taxes, Workers’ Compensation, or Public Liability Codes

Depending on the particular tab, enter/select the burden allocated to the job. If all burdens of that type are to be allocated to a particular category element, enter the code “ALL”.

Cost Code, Category, Cost Pool Allocation Job

Enter/select the cost code, category, and job code of the job pool having the burdens transferred if this differs from the job selected on timesheet entry. Leave these fields blank to have the burdens remain with the timesheet entry job.

Active – Checkbox

An ‘Active’ checkbox is located on each line of each tab, to show the active status of the allocation line item. If checked, the job burden allocation setup is active and should be included in processing. If unchecked, the job burden allocation setup is inactive and should not be included in processing.

For example, when a line item is checked, after timesheet posting and processing payroll, the burden will be processed against the job, cost code, and category assigned and allocated to the cost code, category, and cost pool allocation job specified in the line’s setup. When unchecked, the burden will still be processed against the job, cost code, and category assigned, but it will not be allocated to the cost pool allocation job, cost code, and category defined in the line’s setup.