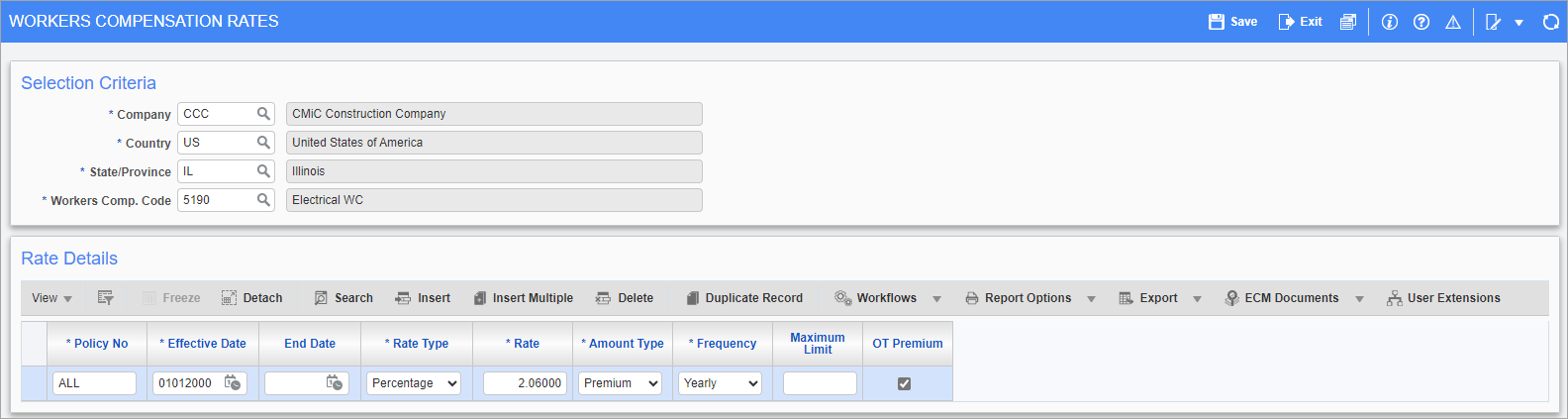

Pgm: PYWCRATE –Workers' Compensation Rates; standard Treeview path: US Payroll > Administration > Worker Compensation > Rates By Code

This screen is used to enter rates for specific workers’ compensation policies. Rates may be entered against specific or all workers’ compensation policy numbers.

Selection Criteria

Company, Country, State/Province, Workers’ Comp. Code

Enter/select the codes for the company, country, state, and policy.

Rate Details

Policy Number

Enter the policy number for the workers’ compensation code.

If there is no specific policy number associated with the workers’ compensation code, enter “ALL”. This establishes the rate for all policies which fall under this workers’ compensation code.

Effective Date, End Date

Enter the start and end dates for the workers’ compensation rate. Leave the End Date field blank to use the rate indefinitely.

Rate Type

Select whether the rate is calculated as a percentage of gross earnings or a premium for each normal hour worked.

Rate

Enter the percentage rate or per hour pay rate used when calculating this workers’ compensation code. When entering a percentage, enter “10” to represent 10%.

Amount Type

Select whether the amount given by the rate is a gross or a premium.

Frequency

Select whether the policy is calculated on a weekly or yearly basis. This affects the amount entered in the Maximum Limit field. For example, if the frequency is set to "Weekly" and the pay is biweekly, the maximum limit will double.

Maximum Limit

Enter the maximum value for the workers’ compensation policy for the period defined in the Frequency field. Workers’ compensation is not calculated above this amount.

The system accumulates the transaction values for the year until it reaches the maximum. Once reached, the transaction code is not calculated again until the period is over.

OT Premium

Check this box if the workers’ compensation policy should be paid using the overtime rate multipliers on overtime hours.

For example, if the regular pay rate for an employee is $10 per hour, the overtime multiplier is 1.5, and the employee worked 40 regular hours and 5 overtime hours, the amount is calculated as (40 NH * $10 + 5 OH * $15) = $475 if the box is checked. If the box is unchecked the amount is calculated as (45 total hours * $10) = $450.