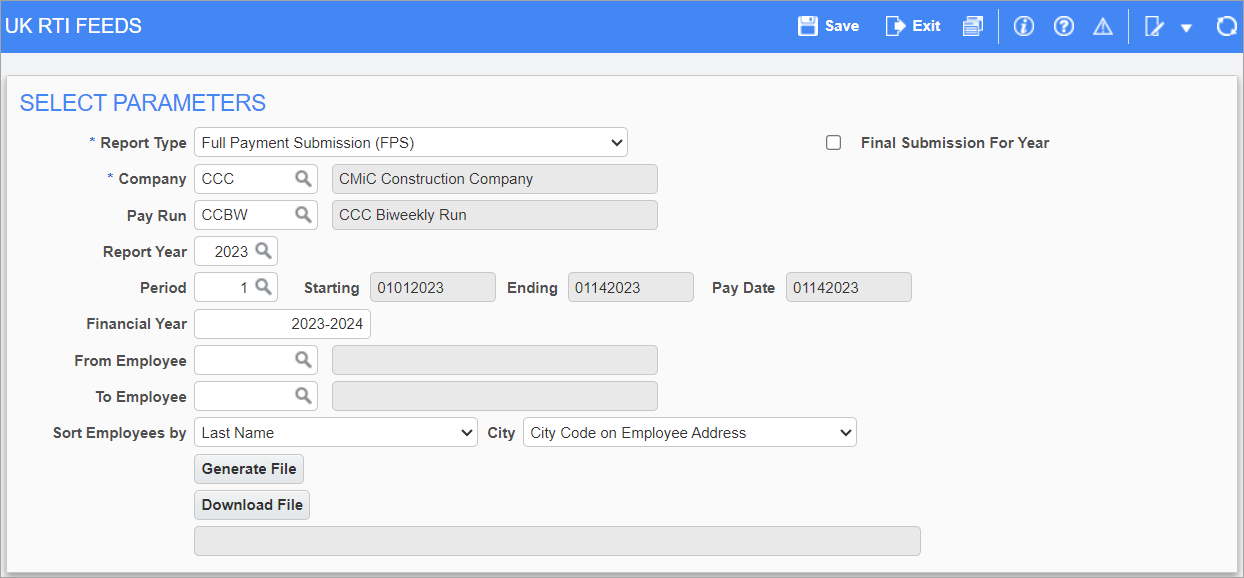

Pgm: PYUKRTIPARM – UK RTI Feeds; standard Treeview path: International Payroll > Government Forms > UK Forms

A Real-Time Information (RTI) feed is used by employers in the UK for tax purposes. An RTI report is required every time employees are paid and is used regularly throughout the tax year. Users can generate full payment submission (FPS) reports and/or employer payment summary (EPS) reports, as well as P11D, P11D(b), P9D, and P60 government reports.

Report Type

Select one of the following government report types from the drop-down menu:

-

Full Payment Submission (FPS)

-

Employer Payment Summary (EPS)

-

Employer Payment Summary Final (EPSF)

-

Employer Alignment Submission (EAS)

-

P11D File

-

P11D(b) File

-

P9D File

-

P60 File

Final Submission For Year – Checkbox

Check this box if this is the final report of the financial tax year.

Company

Enter/select the company code.

Pay Run

Enter/select the pay run to be processed.

Report Year

Enter/select the report year.

Period

Enter/select the pay period to include on the report.

Financial Year

This field's value defaults from the Report Year field and is editable. This is the 12-month period used in the UK for tax purposes.

From Employee, To Employee

Enter/select the range of employees. To complete the form for a single employee, enter the same code in both the From and To fields. To complete the form for the full range of employees, leave both these fields blank.

Sort Employees by

Select Employee Code, Last Name, or SSN from the drop-down menu to sort the report.

City

Select one of the following address lines to include on the report:

-

Address Line 2

-

Address Line 3

-

City Code on Employee Address

-

Address Last Filled Line

-

No Action

[Generate File] – Button

Press this button to generate the RTI report.

[Download File] – Button

Press this button to download the RTI report as a TXT file.