Overview

In 2020, the IRS introduced Form 1099-NEC for reporting Non-Employee Compensation. Following the creation of this new form, the IRS also revised Form 1099-MISC.

This

NOTE: The accumulator codes, box codes and minimums and the relationship are set up for testing purposes and are indicative only. Users must set up as per their business requirements and according to IRS documents.

Form 1099-NEC

Setup

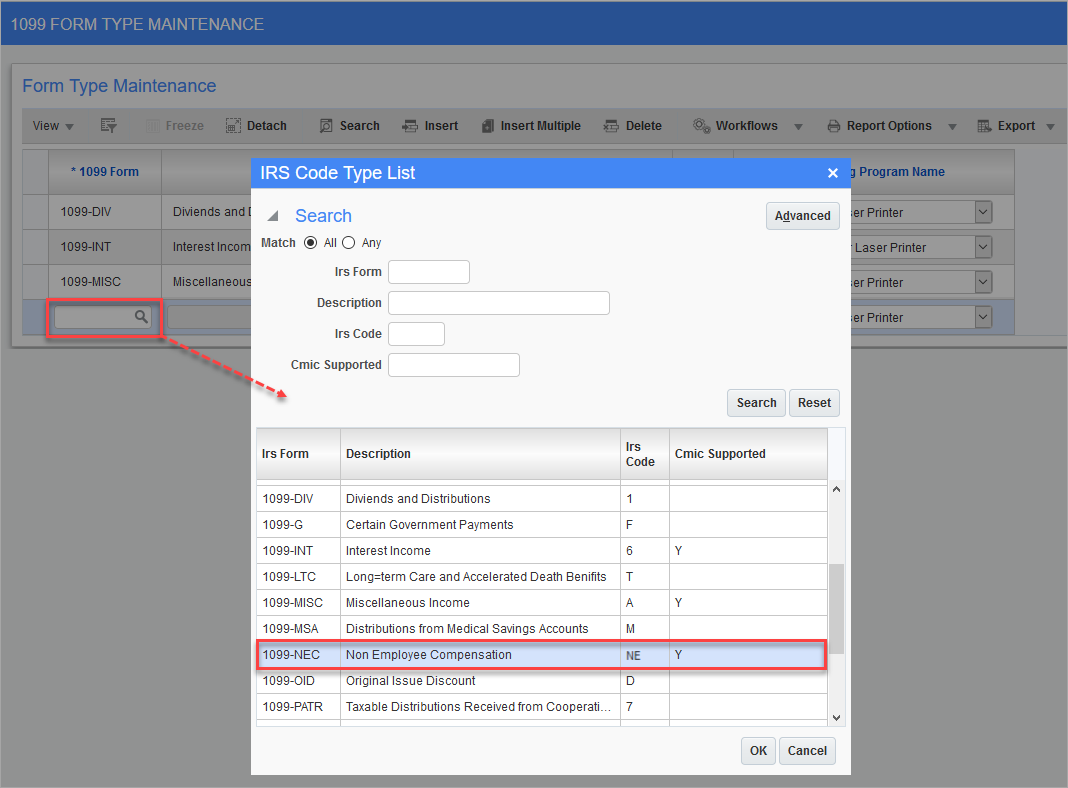

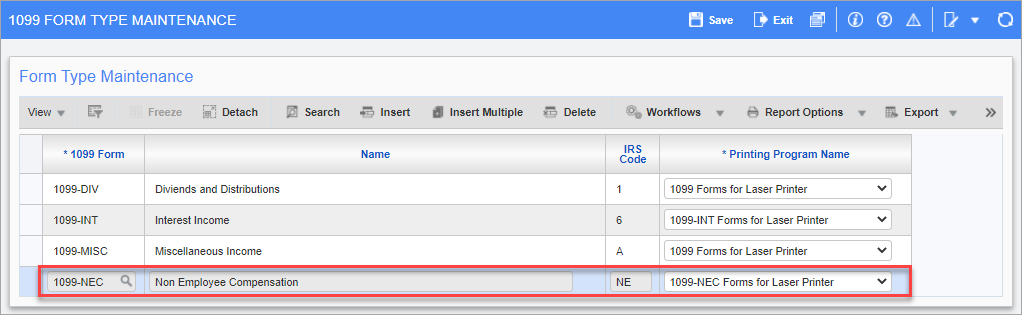

Form Codes

Pgm: N1099FRM - 1099 Form Type Maintenance; standard Treeview path: Accounts Payable > Utilities > 1099 > Setup > Form Codes

On the 1099 Form Type Maintenance screen, insert a new record using the [Insert] button on the Block Toolbar and then enter/select "1099-NEC" in the 1099 Form field.

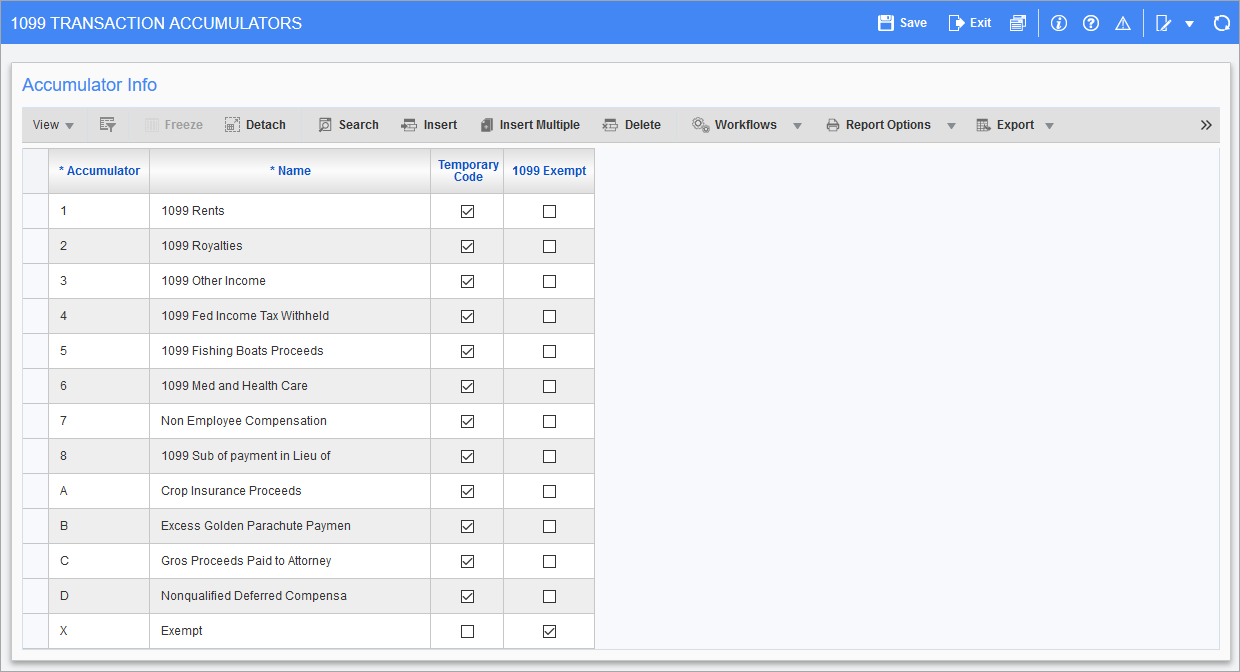

Accumulator Codes

Pgm: N1099ACC –1099 Transaction Accumulators; standard Treeview path: Accounts Payable > Utilities > 1099 > Setup > Accumulator Codes

Set up accumulators as required on the 1099 Transaction Accumulators screen. In this example, the accumulator codes are for most 1099 form types such as 1099-MISC and 1099-NEC.

Box Codes and Minimums

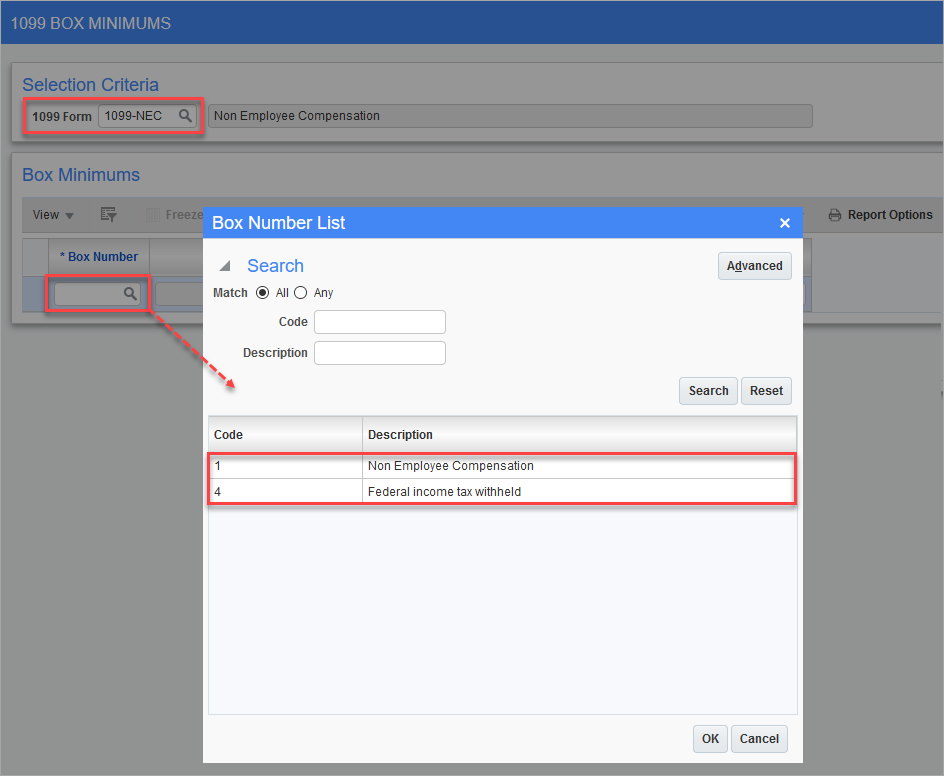

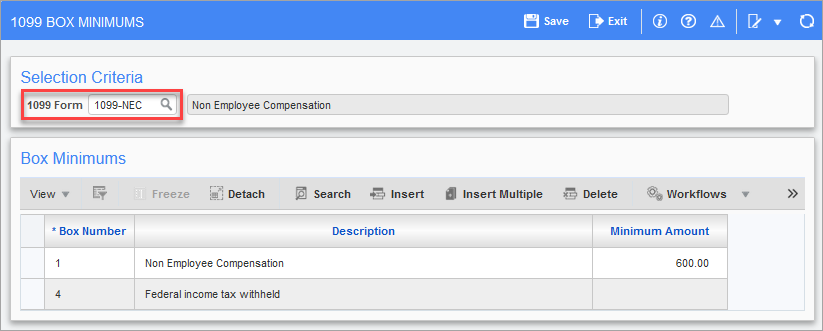

Pgm: N1099MIN – 1099 Box Minimums; standard Treeview path: Accounts Payable > Utilities > 1099 > Setup > Box Codes and Minimums

In the Selection Criteria section of the 1099 Box Minimums screen, enter/select "1099-NEC" in the 1099 Form field. In the Box Minimums section of the screen, insert two new records using the [Insert] button on the Block Toolbar. In the Box Number field, enter/select box numbers 1 and 4, as shown in the screenshot above.

Enter the minimum amount for each of the box numbers.

Box Code/Accumulator Relations

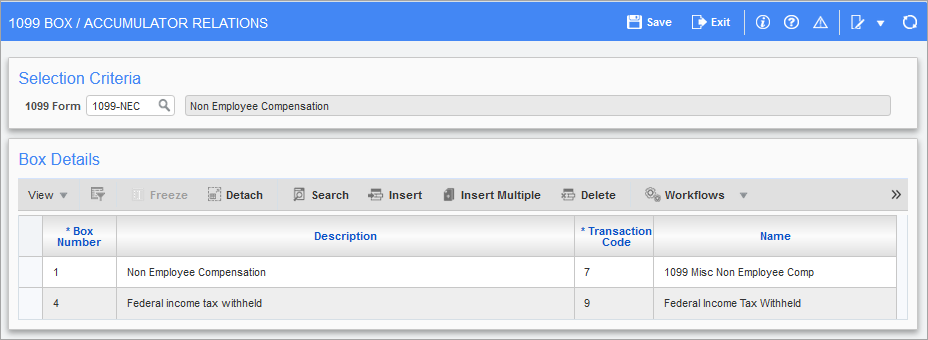

Pgm: N1099BOX – 1099 Box/Accumulator Relations; standard Treeview path: Accounts Payable > Utilities > 1099 > Setup > Form Codes > Box/Accumulator Relations

Maintain the existing setup on the 1099 Box/Accumulator Relations screen.

NOTE: This setup may differ based on user setup requirements.

Processing

Once the setup has been completed, perform the following processing steps, as required, to create a 1099 working file for Form 1099-NEC:

-

Maintain the tax payer information previously defined on the 1099 Payers Maintenance screen for Form 1099-NEC (standard Treeview path: Accounts Payable > Utilities > 1099 > Setup > Payer Info).

-

Update checks if required.

-

Update/create 1099 information for the required year (mandatory requirement).

-

Adjust 1099 vendor balances, if required.

-

Create 1099 working files (mandatory requirement).

-

Edit 1099 working files, if required. This may be performed to adjust the amounts for reporting.

-

Print 1099 (Jasper Report if printing on IRS Form).

-

Create media files (XML output if using Greenshades to file 1099 reporting to IRS).

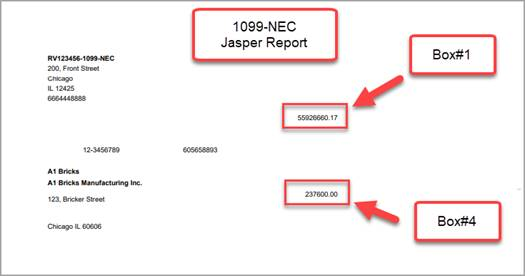

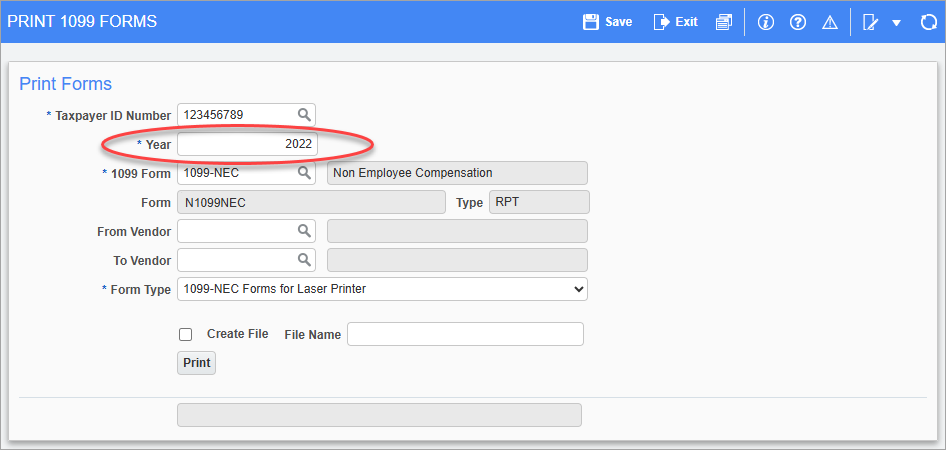

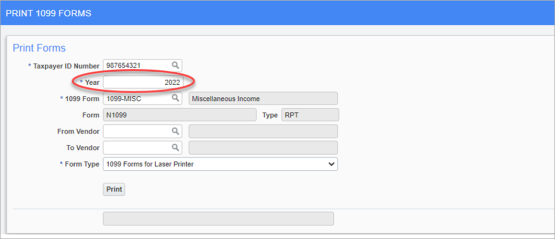

Printing 1099-NEC (Jasper Report)

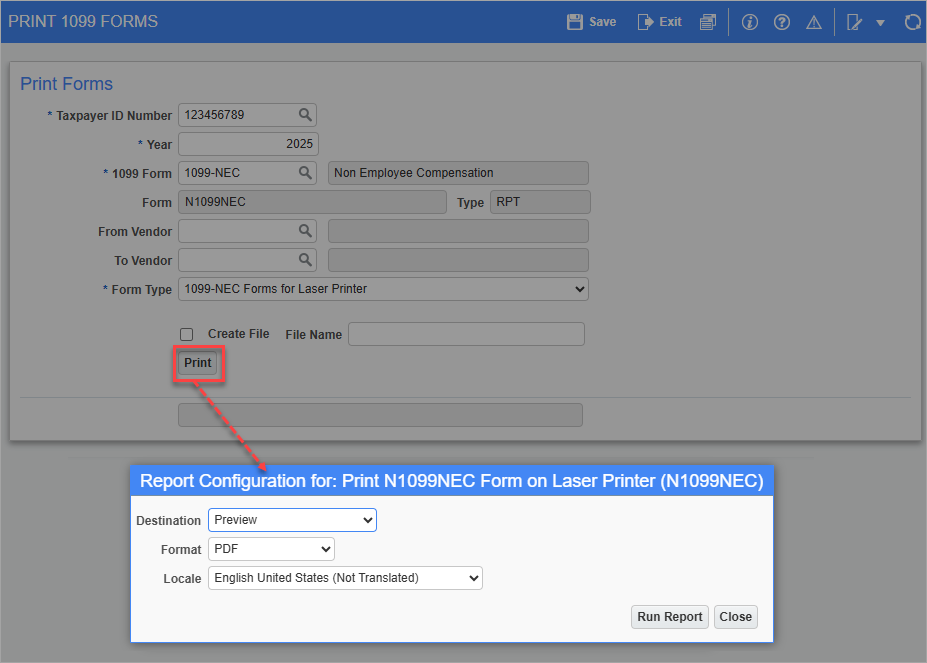

Pgm: N1099PRT – Print 1099 Forms; standard Treeview path: Accounts Payable > Utilities > 1099 > Create 1099 > Print 1099s

Navigate to the Print 1099 Forms screen and select the taxpayer ID, enter the year, and select "1099-NEC" in the 1099 Form field to print the new

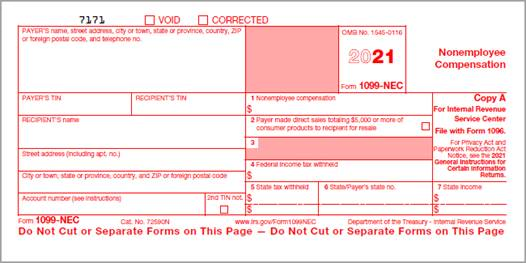

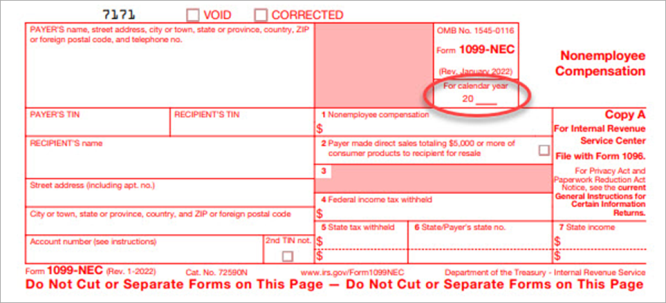

Printing Calendar Year in 2022 1099-NEC Form

The 2022 1099-NEC form doesn't include a form year but allows payers to indicate the calendar year for which payments are being reported. The CMiC 1099 Jasper Report for NEC has been modified to print the last two digits of the calendar year in the "For calendar year" box as shown below.

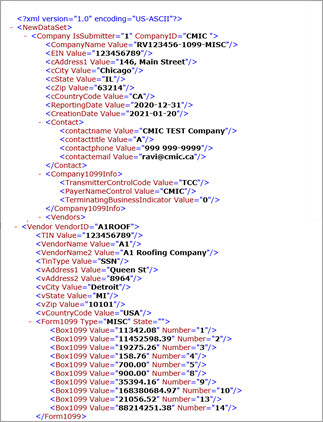

Creating Media File for 1099-NEC (XML Output)

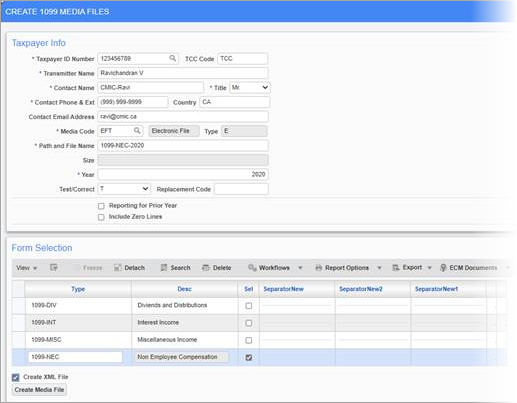

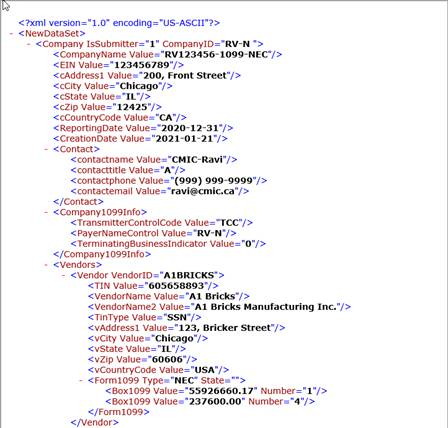

Pgm: N1099FIL – Create 1099 Forms; standard Treeview path: Accounts Payable > Utilities > 1099 > Create 1099 > Create 1099 Media Files

Navigate to the Create 1099 Media Files screen and select the taxpayer ID number, enter the year and any other additional details to create the media file. The XML output file generated is shown below.

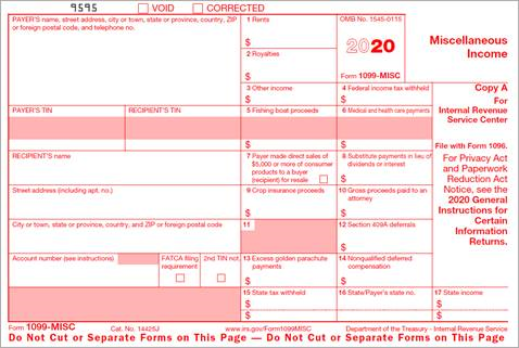

Form 1099-MISC

Changes to Form 1099-MISC

Following the creation of Form 1099-NEC, the IRS also revised Form 1099-MISC and rearranged the box numbers for reporting certain incomes.

The Non-Employee compensation info (Box 7) is no longer a part of the Form 1099-MISC and has been removed.

-

Box #7 - Payer made direct sales of $5,000 or more are now reported in box 7 with a checkbox.

-

Box #9 - Crop insurance proceeds are reported in box 9.

-

Box #10 - Gross proceeds to an attorney are reported in box 10.

-

Box #14 - Nonqualified Deferred Compensation are reported in box 14.

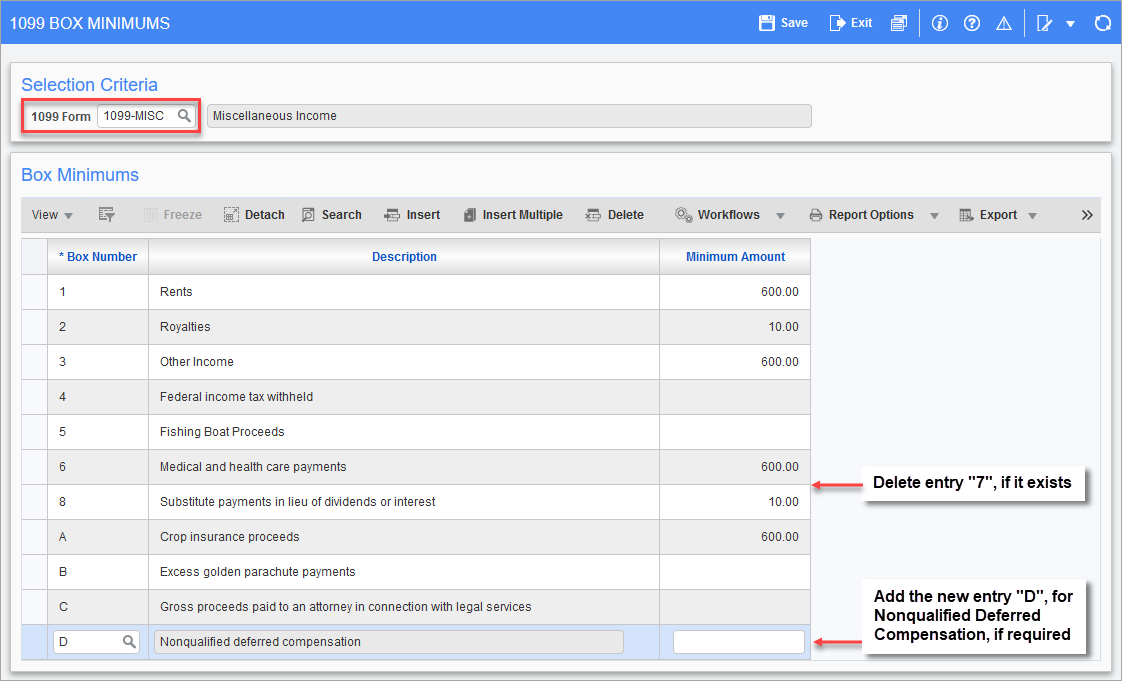

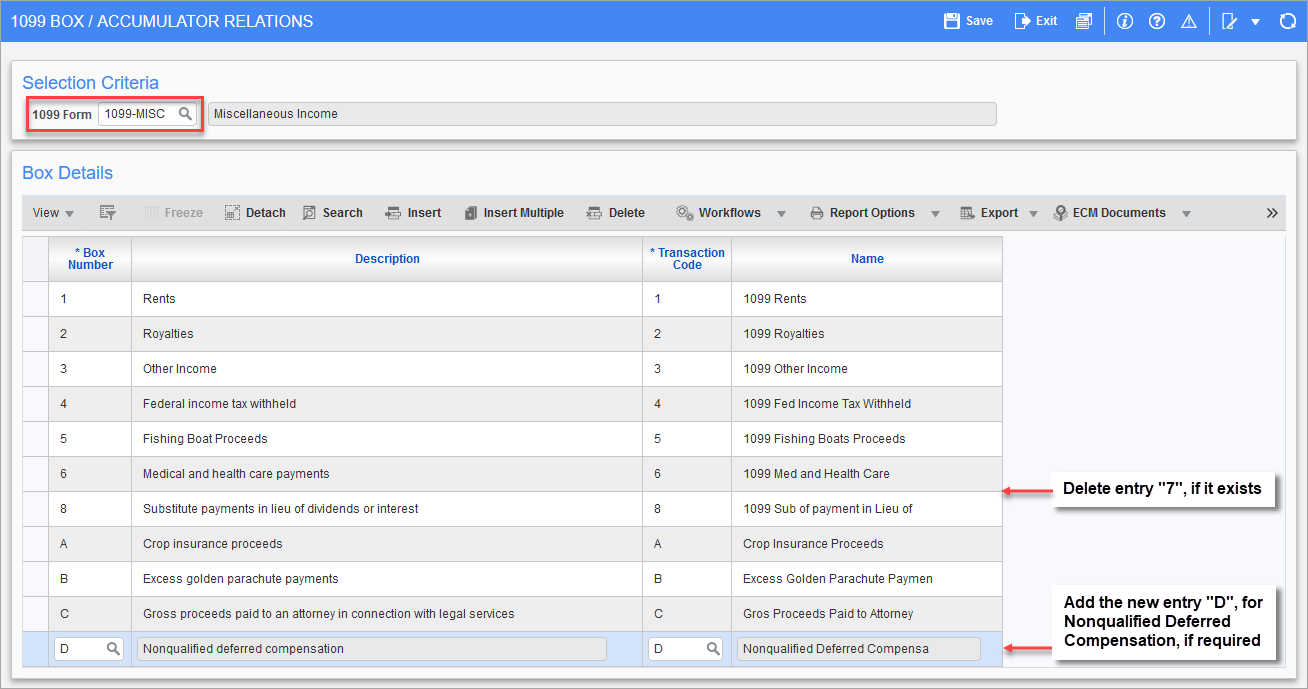

Updates Required to CMiC 1099-MISC Setup

Users must make the following changes in CMiC to their existing 1099-MISC setup.

- Navigate to the 1099 Box Minimums screen (Pgm: N1099MIN), located in Accounts Payable > Utilities > 1099 > Setup > Box Codes and Minimums.

- In the 1099 Form field, select "1099-MISC", then select Box Number "7" and delete the entry, as Non-Employee Compensation is no longer a part of Form 1099-MISC. Click on [Save].

- CMiC created a new box code "D: Nonqualified Deferred Compensation" for reporting in Box #14. If required, add this new entry and set any maximums. Click on [Save].

- Navigate to the 1099 Box/Accumulator Relations screen (Pgm: N1099BOX), located in Accounts Payable > Utilities > 1099 > Setup > Box/Accumulator Relations.

- In the 1099 Form field, select "1099-MISC", then select Box Number "7" if it exists and delete the entry. Click on [Save].

- Add entry for box code "D", if required, to report Nonqualified Deferred Compensation. Click on [Save].

The following screenshots show the resulting updated screens.

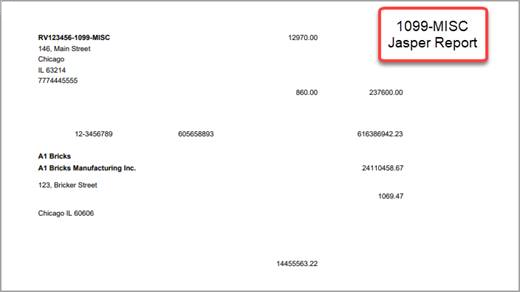

Printing 1099-MISC (Jasper Report)

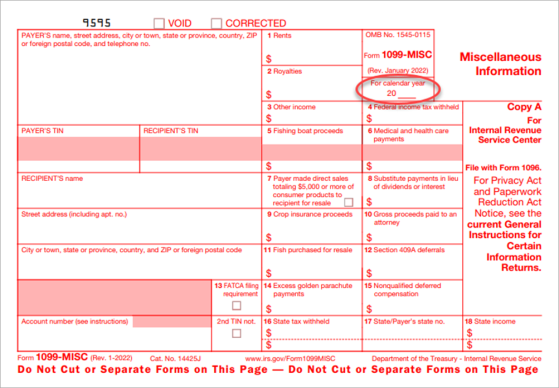

Printing Calendar Year in 2022 1099-MISC Form

The 2022 1099-MISC form doesn't include a form year but allows payers to indicate the calendar year for which payments are being reported. The CMiC 1099 Jasper Report for MISC has been modified to print the last two digits of the calendar year in the "For calendar year" box as shown below.

Creating Media File for 1099-MISC (XML Output)