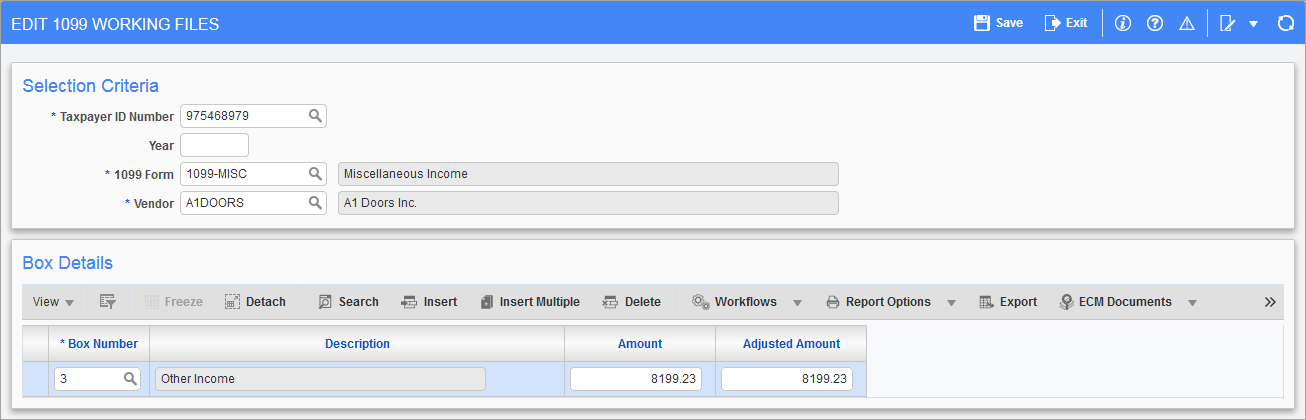

Pgm: N1099EDT – Edit 1099 Working Files; standard Treeview path: Accounts Payable > Utilities > 1099 > Process > Edit 1099 Working Files

This screen shows every vendor’s box amount for each type of 1099 and each TIN.

This screen can also be used to alter the adjusted amount, rather than doing so in the Adjust 1099 Vendor Balance screen. The values in the Adjusted Amount column are what will be reported to the IRS.

It is also possible to add vendors and amounts to the working file using this screen by pressing the [Insert] button in the Box Details section. This is not normally standard practice, but if there is another company operating outside of CMiC that reports using the same TIN number, it may be necessary to do so. If vendors are added here, the vendor must exist in the CMiC business partner file.

To view the information, enter the required criteria in the selection criteria section and select the vendor from the list of values. The Box Details section displays all the box summaries for the vendor. Again, if needed, the adjusted amount may be changed.